Actualités & Médias

BASF Group sales slightly lower in second quarter;

EBIT before special items considerably below prior-year quarter

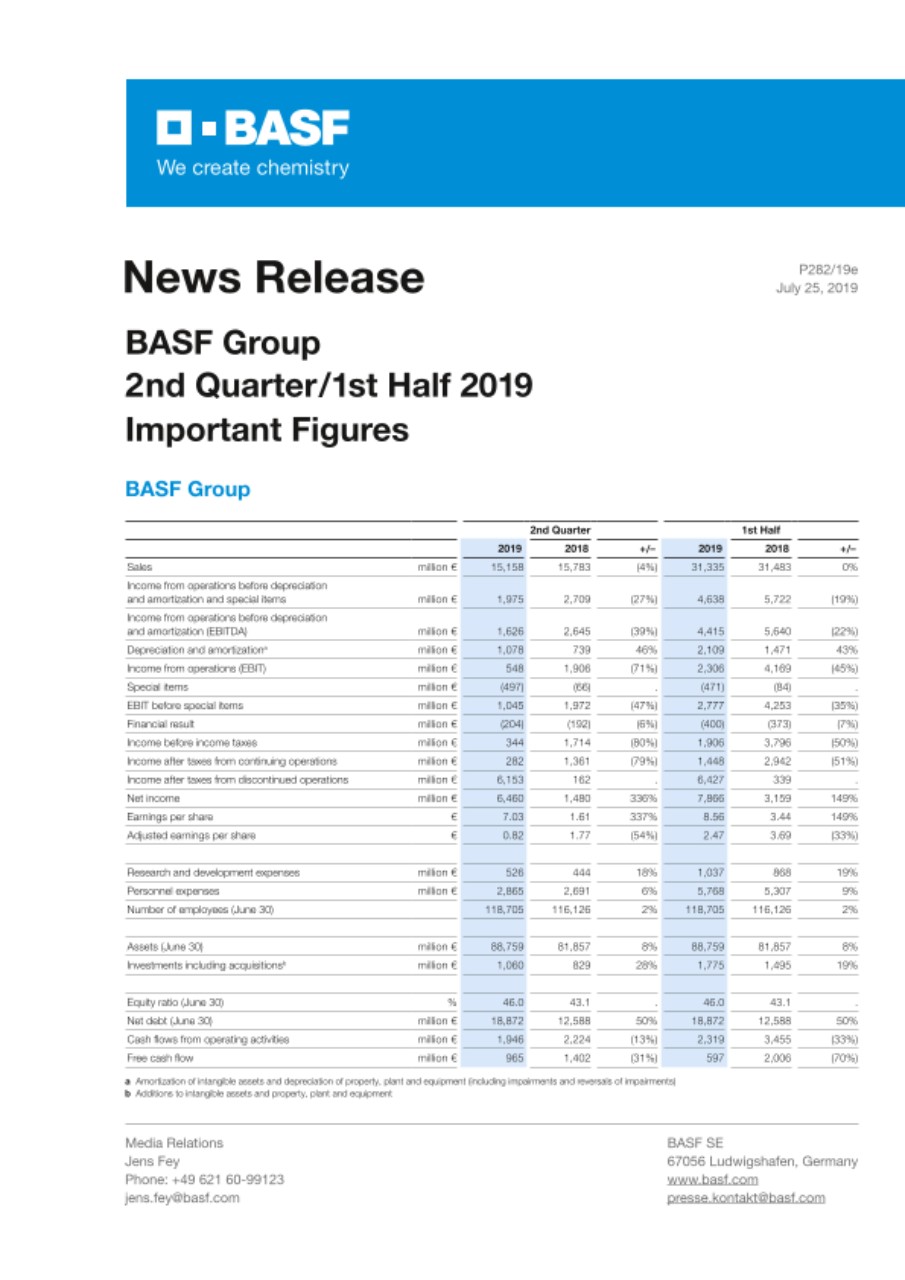

- Sales of €15.2 billion (minus 4%)

- EBITDA before special items of €2 billion (minus 27%)

- EBIT before special items of €1 billion (minus 47%)

- Net income of €6.5 billion resulting from deconsolidation of Wintershall (plus €5 billion compared with second quarter 2018)

- Brudermüller: “BASF is implementing strategic growth initiatives rapidly, thoroughly and rigorously.”

The macroeconomic environment became challenging for BASF in the second quarter of 2019. “There is currently high uncertainty, low visibility and poor predictability,” said Dr. Martin Brudermüller, Chairman of the Board of Executive Directors of BASF SE, during a conference call. “Our second-quarter results clearly reflect this.”

Compared with the second quarter of the previous year, sales decreased by 4% to €15.2 billion. Prices were down by 2%, mainly driven by the isocyanates and cracker products businesses. Sales volumes declined by 6%. All segments recorded lower volumes, except for Nutrition & Care. The decline was most pronounced in the Chemicals and Agricultural Solutions segments. The reasons for this were the scheduled steam cracker turnarounds in Antwerp, Belgium, and Port Arthur, Texas, as well as the unfavorable weather conditions in North America affecting the Agricultural Solutions segment. Portfolio effects accounted for plus 2% thanks to the seeds and non-selective herbicide businesses acquired from Bayer. Currency effects amounted to plus 2%.

EBITDA before special items decreased by 27% to €2 billion. EBIT before special items came in at €1 billion, 47% lower than in the prior-year period.

The global trade conflicts, particularly between the United States and China, are a serious concern for the company. “We followed the general assessment that a solution would be found by the middle of the year. But now it seems the situation will not ease for some time,” said Brudermüller. BASF already published its key figures in an ad-hoc release on July 8. The company’s 2019 outlook presented in February of this year was based on certain macroeconomic and geopolitical assumptions. “Unfortunately, many of these did not materialize and we therefore had to lower our outlook,” said Brudermüller. He added that the adjusted outlook would not change BASF’s progressive dividend policy: “We want to increase our dividend per share each year.”

New strategy being implemented with speed and determination

With its new strategy, BASF defined numerous measures for more customer focus and efficiency as well as for a more effective organization of the company. “Despite the challenges, we will implement our strategic growth initiatives rapidly, thoroughly and rigorously,” said Brudermüller.

BASF is currently reshaping its organization, streamlining administration, sharpening the roles of the service units and regions and simplifying procedures and processes. In recent months, significant parts of the functional services have been embedded in the operating divisions. As of the end of July, 15,000 employees are working closer to customers and more will be doing so by October. Furthermore, the company has defined a lean corporate center with fewer than 1,000 employees to support the Board of Executive Directors in steering the BASF Group. This corporate center accounts for less than 1% of the total workforce. The remaining service activities will be assigned to four cross-functional service units. They will initially comprise approximately 29,000 employees.

These measures are part of BASF’s excellence program. Leaner structures and simplified processes should lead to savings of around €300 million annually. “A considerable contribution is also anticipated from operational excellence measures in production, logistics and planning. Digitalization and automation will play an important role as well. Overall, we expect an EBITDA contribution of €2 billion annually from the end of 2021 onward,” said Brudermüller.

As previously announced, BASF plans to reduce around 6,000 positions worldwide by the end of 2021. This will result from organizational simplification and from efficiency gains in administration, services and the operating divisions. In addition, central structures are being streamlined in the context of the announced portfolio changes in the construction chemicals and pigments businesses.

Brudermüller provided an update on the severance program: “At BASF SE in Ludwigshafen, more than 1,100 employees accepted an offer and signed termination agreements in the first half of the year.”

Growth in BASF’s customer industries below expectations in the first half of 2019

Looking back, growth in BASF’s customer industries in the first half of the year was significantly below expectations. Growth in industrial production slowed considerably around the world. For example, automotive production: The original overall forecast for 2019 was plus 0.8% but it declined worldwide by 6% in the first half-year. In China, there was even a drop of 13%. Compared to the prior-year period, chemical production declined by 0.5% in BASF’s home market of Europe. The downturn in Germany was particularly pronounced at minus 3.5%.

The agriculture sector suffered from prolonged heavy precipitation in the major growing regions of North America. Brudermüller: “Flooding and extreme conditions literally led to bad weather for our Agricultural Solutions business.”

Chemicals and Materials segments impact second-quarter earnings

Dr. Hans-Ulrich Engel, Chief Financial Officer of BASF SE, discussed the second-quarter figures. As in the entire first half of 2019, earnings in the second quarter of 2019 were significantly negatively impacted by the lower volumes and margins in the Chemicals and Materials segments. “In total, the two segments accounted for 83% of the overall earnings decline in the second quarter of 2019,” Engel said.

Earnings in the Agricultural Solutions segment considerably decreased as well. This was mainly due to the seasonally negative earnings of the acquired businesses and lower volumes in the crop protection business. Significantly higher earnings in Industrial Solutions and slightly higher earnings in the Surface Technologies and Nutrition & Care segments could only partially offset the decline.

Special items in EBIT totaled minus €497 million compared with minus €66 million in the second quarter of 2018. The increase in special items was due in part to one-time costs for the excellence program. Moreover, there was an impairment of a natural gas-based investment on the U.S. Gulf Coast, which BASF is no longer pursuing. In addition, the integration of the acquired businesses and assets from Bayer led to special items in the Agricultural Solutions segment. EBIT decreased from €1.9 billion in the prior-year period to €548 million in the second quarter of 2019.

Net income amounted to €6.5 billion, compared with €1.5 billion in the second quarter of 2018. Reported earnings per share increased from €1.61 to €7.03 in the second quarter of 2019. This was due to the book gain from the deconsolidation of Wintershall following the closing of the merger of Wintershall and DEA. Adjusted earnings per share amounted to €0.82; this compares with €1.77 in the prior-year quarter.

The cash flows from operating activities came in at €1.9 billion, compared with €2.2 billion in the second quarter of 2018. The free cash flow decreased by 31% to €965 million.

New macroeconomic assumptions for 2019 outlook

“The global economic risks have increased significantly during recent months,” said Brudermüller. “This has been driven by geopolitical developments and the ongoing trade conflicts between the United States and its trading partners. These conflicts will not be resolved in the near future and are causing a noticeable slowdown in macroeconomic growth around the world, particularly in China.”

BASF significantly lowered its 2019 growth expectations for global industrial production and for global chemical production – from 2.7% to around 1.5% in both cases. “The automotive industry – an important customer industry for BASF – will not recover this year. We now expect a global decline of minus 4.5% over the full year,” said Brudermüller. “Customers in all industries are currently very cautious with projections and ordering. Our visibility on demand development is also very low.”

BASF Group outlook for 2019 adjusted

With a view to the challenging macroeconomic environment, the 2019 outlook for BASF Group was adjusted on July 8: BASF now anticipates a slight decline in sales. For EBIT before special items, the company expects a considerable decline of up to 30%. Return on capital employed (ROCE) for the full year 2019 is anticipated to decline considerably compared with the previous year.

Receive the latest press releases from BASF via WhatsApp on your smartphone or tablet. Register for our news service at basf.com/whatsapp-news.

About BASF

At BASF, we create chemistry for a sustainable future. We combine economic success with environmental protection and social responsibility. The approximately 122,000 employees in the BASF Group work on contributing to the success of our customers in nearly all sectors and almost every country in the world. Our portfolio is organized into six segments: Chemicals, Materials, Industrial Solutions, Surface Technologies, Nutrition & Care and Agricultural Solutions. BASF generated sales of around €63 billion in 2018. BASF shares are traded on the stock exchange in Frankfurt (BAS) and as American Depositary Receipts (BASFY) in the U.S. Further information at www.basf.com.

On Thursday, July 25, 2019, you can obtain further information online at the following addresses:

| Half-Year Financial Report (from 07:00 a.m. CEST) | |

| basf.com/halfyearfinancialreport | (English) |

| basf.com/halbjahresfinanzbericht | (German) |

| News Release (from 07:00 a.m. CEST) | |

| basf.com/pressrelease | (English) |

| basf.com/pressemitteilungen | (German) |

| Live Transmission (from 09:00 a.m. CEST) | |

| basf.com/pcon | (English) |

| basf.com/pressekonferenz | (German) |

| Speech (from 09:00 a.m. CEST) | |

| basf.com/pcon | (English) |

| basf.com/pressekonferenz | (German) |

|

Live Transmission – Telephone Conference for analysts and investors (from 11:00 a.m. CEST) |

|

| basf.com/share/conferencecall | (English) |

| basf.com/aktie/telefonkonferenz | (German) |

| Photos | |

| basf.com/pressphotos | (English) |

| basf.com/pressefotos | (German) |

| Current TV footage | |

| tvservice.basf.com/en | (English) |

| tvservice.basf.com | (German) |

Forward-looking statements and forecasts

This release contains forward-looking statements. These statements are based on current estimates and projections of the Board of Executive Directors and currently available information. Forward-looking statements are not guarantees of the future developments and results outlined therein. These are dependent on a number of factors; they involve various risks and uncertainties; and they are based on assumptions that may not prove to be accurate. BASF does not assume any obligation to update the forward-looking statements contained in this release above and beyond the legal requirements.

P-19-281