Corporate Governance & Management

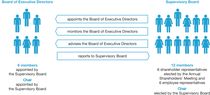

The fundamental elements of BASF SE’s corporate governance system are: its two-tier management system, with a transparent and effective separation of company management and supervision between BASF’s Board of Executive Directors and the Supervisory Board; the equal representation of shareholders and employee representatives on the Supervisory Board; and the shareholders’ rights of coadministration and supervision at the Annual Shareholders’ Meeting.

Direction and management by the Board of Executive Directors

The Board of Executive Directors is responsible for the management of the company and represents BASF SE in business undertakings with third parties. BASF’s Board of Executive Directors is strictly separated from the Supervisory Board, which monitors the Board of Executive Directors’ activities and decides on its composition. A member of the Board of Executive Directors cannot simultaneously be a member of the Supervisory Board. As the central duty of company management, the Board of Executive Directors defines the corporate goals and strategic direction of the BASF Group as well as its individual business areas, including the sustainability strategy. In doing so, the Board ensures that the opportunities and risks associated with social and environmental factors for our company as well as the ecological and societal impacts of BASF’s activities are systematically identified and evaluated. In addition to long-term economic goals, the corporate strategy appropriately takes environmental and social objectives into account, too. The corporate planning defined on this basis comprises financial and sustainability-related goals.

Furthermore, the Board of Executive Directors determines the company’s internal organization and decides on the composition of management positions on the levels below the Board. It also manages and monitors BASF Group business by planning and setting the corporate budget, allocating resources and management capacities, monitoring and making decisions on significant individual measures, and supervising operational management.

The Board’s actions and decisions are geared toward the company’s best interests. It is committed to the goal of sustainably increasing the company’s value and developing the company over the long term, taking into account environmental and social goals as well as economic targets. The Board’s responsibilities include the preparation of the Consolidated and Separate Financial Statements of BASF SE and reporting on the company’s financial and nonfinancial performance as well as half-year and quarterly reporting.

Furthermore, it must ensure that the company’s activities comply with the applicable legislation and regulatory requirements as well as internal corporate directives (compliance). This includes the establishment of appropriate systems for control, compliance and risk management as well as establishing a company-wide compliance culture with undisputed standards.

Decisions that are reserved for the Board as a whole by law, through the Board of Executive Directors’ Rules of Procedure or through resolutions adopted by the Board, are made and all important matters of the company are discussed at regularly held Board meetings called by the chair of the Board of Executive Directors. Board decisions are based on detailed information and analyses provided by the business areas and specialist units and, if deemed necessary, by external consultants. The chair of the Board of Executive Directors leads the Board meetings. Board decisions can generally be made via a simple majority. In the case of a tied vote, the chair of the Board of Executive Directors gives the casting vote. However, the chair of the Board of Executive Directors cannot enforce a decision against the Board of Executive Directors’ majority vote. The chair of the Board also does not have the right to veto. Outside of matters that are assigned to the entire Board for consultation and decision-making, all members of the Board of Executive Directors are authorized to make decisions individually in their designated areas of responsibility.

The Board of Executive Directors can set up Board committees to consult and decide on individual issues such as proposed material acquisition or divestiture projects or to prepare decisions to be made by the entire Board. These must include at least three members of the Board of Executive Directors. For the preparation of important decisions, such as those on acquisitions, divestitures, investments and personnel, the Board has various commissions at the level below the Board. With the support of the specialist units and independently of the affected business area, these committees thoroughly assess the planned measures and evaluate the associated opportunities and risks. Based on this information, they report and make recommendations to the Board.

The Board of Executive Directors informs the Supervisory Board regularly, without delay and comprehensively, of all issues important to the company with regard to planning, business development, risk situation, risk management and compliance. Furthermore, the Board of Executive Directors coordinates the company’s strategic orientation with the Supervisory Board.

The Statutes of BASF SE and the Supervisory Board have defined certain transactions that require the Board of Executive Directors to obtain the Supervisory Board’s approval prior to their conclusion. Such cases that require approval include the acquisition and disposal of enterprises and parts of enterprises, as well as the issue of bonds or comparable financial instruments. However, this is only necessary if the acquisition or disposal price or the amount of the issue in an individual case exceeds 3% of the equity reported in the most recent approved Consolidated Financial Statements of the BASF Group.

Competence profile, diversity concept and succession planning for the Board of Executive Directors

The Supervisory Board works hand in hand with the Board of Executive Directors to ensure long-term succession planning for the composition of the Board of Executive Directors. BASF aims to fill most Board positions with leaders from within the company. It is the task of the Board of Executive Directors to propose a sufficient number of suitable individuals to the Supervisory Board.

BASF’s long-term succession planning is guided by the corporate strategy. It is based on systematic management development characterized by the following:

- Early identification of suitable leaders of different professional backgrounds, nationalities and genders

- Systematic development of leaders through the successful assumption of tasks with increasing responsibility, where possible in different business areas, regions and functions

- Desire to shape strategic and operational decisions and proven success in doing so, as well as leadership skills, especially under challenging business conditions

- Role model function in putting corporate values into practice

The aim is to enable the Supervisory Board to ensure a reasonable level of diversity with respect to education and professional experience, cultural background, international representation, gender and age when appointing members of the Board of Executive Directors. Irrespective of these individual criteria, a holistic approach will determine a person’s suitability for appointment to the Board of Executive Directors of BASF SE. Both systematic succession planning and the selection process aim to ensure that the Board of Executive Directors as a whole has the following profile, which serves as a diversity concept:

- Many years of leadership experience in scientific, technical and commercial fields

- International experience based on background and/or professional experience

- At least one female Board member

- A balanced age distribution to ensure the continuity of the Board’s work and enable seamless succession planning

The first appointment of members of the Board of Executive Directors is for a term of no more than three years. The standard age limit for members of the Board of Executive Directors is 63. The Supervisory Board determines the number of members on the Board of Executive Directors. It is guided by insights gained by BASF as a company with an integrated leadership culture and is determined by the needs arising from cooperation within the Board of Executive Directors. The Supervisory Board considers six to be an appropriate number of Board members given the current business composition, future responsibilities associated with development and the fundamental organizational structure of the BASF Group.

The current composition of the Board of Executive Directors meets the competence profile and the requirements of the diversity concept in full.

Supervision of company management by the Supervisory Board

The Supervisory Board appoints the members of the Board of Executive Directors and supervises and advises the Board of Executive Directors on management issues. It must also be involved in making decisions that are of key importance for the company. This also includes the Board of Executive Directors’ consideration of sustainability topics with regard to corporate governance. The Supervisory Board is also responsible for auditing BASF SE’s and the Group’s Annual Financial Statements. As members of the Supervisory Board may not simultaneously be on the Board of Executive Directors, a high level of independence is already structurally ensured with regard to the supervision of the Board of Executive Directors.

In addition to the SE Regulation, the relevant legal basis for the size and composition of the Supervisory Board is provided by the Statutes of BASF SE and the Agreement Concerning the Involvement of Employees in BASF SE (Employee Participation Agreement). The latter also includes the regulations applicable to BASF for implementing the statutory gender quota for the Supervisory Board. The German Codetermination Act does not apply to BASF SE as a European stock corporation (Societas Europaea, SE).

The Supervisory Board of BASF SE comprises 12 members. Six members are elected by the shareholders at the Annual Shareholders’ Meeting via a simple majority. Six members are elected by the BASF Europa Betriebsrat (BASF Works Council Europe), the European employee representation body of the BASF Group. In accordance with the resolution of the Annual Shareholders’ Meeting on June 18, 2020, the period of appointment for newly elected members of the Supervisory Board was reduced from five to four years; and the Statutes were amended accordingly. This ensures that the maximum membership duration of 12 years up to which a Supervisory Board member can be classified as independent in accordance with the German Corporate Governance Code corresponds to a total of three election terms.

Meetings of the Supervisory Board and its four committees are called by their respective chairs and independently, at the request of one of their members or the Board of Executive Directors. The shareholder and employee representatives of the Supervisory Board prepare for Supervisory Board meetings in separate preliminary discussions in each case. Resolutions of the Supervisory Board are passed by a simple majority vote of the participating Supervisory Board members. In the event of a tie, the vote of the chair of the Supervisory Board, who must always be a shareholder representative, shall be the casting vote. This resolution process is also applicable for the appointment and dismissal of members of the Board of Executive Directors by the Supervisory Board. Resolutions can, as needed, also be made in writing or through electronic communication outside of the meetings, as long as no Supervisory Board member objects to this form of passing a resolution. The Supervisory Board meets regularly even without the Board of Executive Directors.

The Board of Executive Directors continually informs the Supervisory Board about matters such as the course of business and expected developments, the financial position and results of operations, corporate planning, the implementation of the corporate strategy, including the sustainability strategy, business opportunities and risks, risk and compliance management and the internal control system. The Supervisory Board has embedded the main reporting requirements in an information policy. The chair of the Supervisory Board is in regular contact with the Board of Executive Directors, especially with its chair, outside of meetings as well.