Targets and Target Achievement 2023

For us, business success tomorrow means creating value for the environment, society and business. That is why we pursue ambitious targets along our entire value chain. We report transparently on target achievement so that our stakeholders can track our progress.

Our objective is profitable growth – we set ourselves the following targets up to and including 2023: We want to grow sales volumes faster than global chemical production, further increase our profitability, achieve a return on capital employed (ROCE) considerably above the cost of capital percentage and increase the dividend per share every year based on a strong free cash flow or at least maintain it at prior-year level.

これからの社会において、ビジネス上の成功とは、環境、社会、自らの事業において価値を創造することを意味します。顧客、投資家、社員、その他のステークホルダーがその進捗状況を確認できるようにするために、財務、非財務の両面で新たな目標を策定しました。

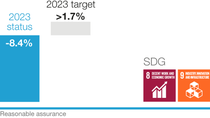

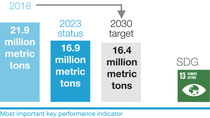

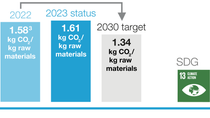

In addition to these financial targets, we have set ourselves broad sustainability targets. We want to considerably reduce our CO2 emissions in the coming years. In addition to the targets for reducing our emissions from production (Scope 1) and the purchase of energy (Scope 2),1 we set ourselves a new target for our purchase of raw materials (Scope 3.1)2 in 2023. We have also added Scope 3.1 emissions to our net-zero target for greenhouse gas emissions by 2050. As part of this target, we are working to strengthen sustainability in our supply chains and use resources more responsibly.

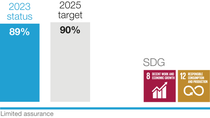

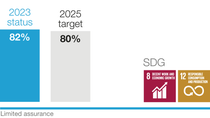

We want to align our product portfolio even more strongly with climate protection and the circular economy. To achieve this, we have further updated the methodology used to assess our product portfolio against defined sustainability criteria and defined a new target figure for products with a particular contribution to sustainability.

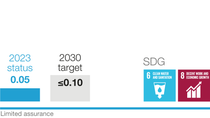

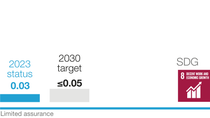

We want to further improve safety in production and since 2023 we have been reporting according to a new system that focuses on high-severity work-related accidents and incidents.

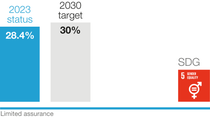

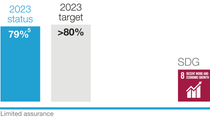

We also aim to increase the number of women in leadership positions and create a working environment in which our employees feel that they can thrive and perform at their best.

The objective of these targets is to grow profitably, and at the same time, contribute to the United Nations’ Sustainable Development Goals (SDGs). We are focusing here on issues that we as a company can influence – especially SDG 2 (Zero hunger), SDG 5 (Gender equality), SDG 6 (Clean water and sanitation), SDG 7 (Affordable and clean energy), SDG 8 (Decent work and economic growth), SDG 12 (Responsible consumption and production) and SDG 13 (Climate action).

Most important KPIs

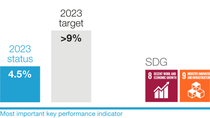

BASF sets itself ambitious targets along the value chain. Two key figures were of particular importance for 2023:

- Return on capital employed (ROCE)

- Absolute CO2 emissions (Scope 1 and 2)

These most important key performance indicators (KPIs) were the main indicators used to steer the BASF Group up to and including 2023. We also use ROCE for employee incentivization, while the achievement of targets for reducing CO2 emissions (Scope 1 and Scope 2) influences the compensation of members of the Board of Executive Directors and senior executives.

From the 2024 financial year, we will establish two new most important key performance indicators at financial level besides CO2 emissions in order to focus more strongly on the short-term value creation of the BASF Group: The following financial key performance indicators are therefore relevant for 2024:

- Income from operations before depreciation, amortization and special items (EBITDA before special items)

- Free cash flow

ROCE remains relevant for steering in the medium term and for incentivization.

1 Scope 1 and Scope 2 (excluding the sale of energy to third parties). The target includes greenhouse gases according to the Greenhouse Gas Protocol, which are converted into CO2 equivalents (CO2e). The baseline year is 2018.

2 Scope 3.1, raw materials excluding battery materials, services and technical goods, excluding greenhouse gas emissions from BASF trading business. Future adjustment of the baseline in line with the TfS guideline possible depending on the availability of further primary data, among other things. The baseline year is 2022.

私たちは市場を上回る成長を実現することにより、経済的に成功し、収益力を高めていきたいと考えています。さらに、現代社会が抱える喫緊の重要課題に対する答えを提示していきます。気候変動や地球温暖化への対策として、BASFは2030年までCO2の排出量を増加させることなく生産量を拡大することを目標として設定しています。これは、温室効果ガスの排出を有機的な成長から切り離す(デカップリング)ということです。また、持続可能な製品ポートフォリオや責任ある調達の実現、社員の意欲向上などの目標も設定しました。人や環境に対する安全性、多様性の受容、そして水管理は引き続き最重要課題となります。

従来の目標に代わるものとして新たに設定したこれらの目標は、 2019年から適用しています。この目標への取り組みを通じて、私たちは持続可能な将来に向けた事業運営を行うとともに、国連の持続可能な開発目標(SDGs)の達成に貢献していきたいと考えています。

財務目標

Effective climate protection

Responsible procurement

Resource-efficient and safe production

Committed employees and diversity

1 Dividend proposed by the Board of Executive Directors

2 Scope 1 and Scope 2 (excluding the sale of energy to third parties). The target includes greenhouse gases according to the Greenhouse Gas Protocol, which are converted into CO2 equivalents (CO2e). The baseline year is 2018.

3 Scope 3.1, raw materials excluding battery materials, services and technical goods, excluding greenhouse gas emissions from BASF trading business. Future adjustment of the baseline in line with the TfS guideline possible depending on the availability of further primary data. The baseline year is 2022.

4 The figure for 2022 was adjusted due to increased data availability.

5 We updated the safety targets in 2023.

6 We regularly calculate the employee engagement level. The most recent survey was conducted in 2023.

1 投下資本利益率(ROCE)は事業活動の収益性を測定する指標です。各事業セグメントから得られたEBITの、事業の用に供した資産の平均値に対するパーセンテージとして算出します。

非財務目標

1 アクセラレーター製品とは、バリューチェーンにおいてサステナビリティに大きく貢献する製品を表します。

2 重要サプライヤーとして位置づけられているサプライヤーからの調達に対する支出。

3 2020年適応,