Investors

Corporate Governance & Management

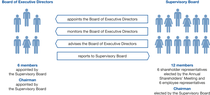

The fundamental elements of BASF SE’s corporate governance system are: its two-tier management system, with a transparent and clear separation of company management and supervision between BASF’s Board of Executive Directors and the Supervisory Board; the equal representation of shareholders and employees on the Supervisory Board; and the shareholders’ rights of coadministration and supervision at the Annual Shareholders’ Meeting.

Direction and management by the Board of Executive Directors

The Board of Executive Directors is responsible for managing the company and represents BASF SE in business undertakings with third parties. It is strictly separated from the Supervisory Board: A member of the Board of Executive Directors cannot simultaneously be a member of the Supervisory Board, as the Supervisory Board monitors the Board of Executive Directors’ activities and decides on its composition. As the central duty of company management, the Board of Executive Directors defines the corporate goals and strategic direction of the BASF Group as well as its individual business areas, including the sustainability strategy. In doing so, the Board ensures that the opportunities and risks associated with social and environmental factors for our company (outside-in perspective) as well as the ecological and societal impacts of BASF’s corporate activities (inside-out perspective) are systematically identified and evaluated. In addition to long-term economic goals, the corporate strategy appropriately takes environmental and social objectives into account, too. The corporate planning defined on this basis comprises financial and sustainability-related goals.

Furthermore, the Board of Executive Directors determines the company’s internal organization and decides on the composition of management positions on the levels below the Board. It also manages and monitors BASF Group business by planning and setting the corporate budget, allocating resources and management capacities, monitoring and making decisions on significant individual measures, and supervising operational management.

The Board’s actions and decisions are geared toward the company’s best interests. It is committed to the goal of sustainably increasing the company’s value and developing the company over the long term, taking into account environmental and social goals as well as economic targets. The Board’s responsibilities include the preparation of the Consolidated and Individual Financial Statements of BASF SE and reporting on the company’s financial and nonfinancial performance as well as half-year and quarterly reporting. It must also ensure that the company’s activities comply with the applicable legislation and regulatory requirements as well as internal corporate requirements (compliance). This includes the establishment and monitoring of appropriate systems for control, compliance and risk management as well as embedding a company-wide compliance culture with undisputed standards.

Decisions that are reserved for the Board as a whole by law, through the Board of Executive Directors’ Rules of Procedure or through resolutions adopted by the Board, are made and all important matters of the company are discussed at regularly held Board meetings called by the Chairman of the Board of Executive Directors. Board decisions are based on detailed information and analyses provided by the operating divisions and Corporate Center units as well as by the service and research units and, if deemed necessary, by external consultants. The Chairman of the Board of Executive Directors leads the Board meetings. Board decisions can generally be made via a simple majority. In the case of a tied vote, the Chairman of the Board of Executive Directors gives the casting vote. However, the Chairman of the Board of Executive Directors cannot enforce a decision against the Board of Executive Directors’ majority vote. The Chairman of the Board also does not have the right to veto. Outside of matters that are assigned to the entire Board for consultation and decision-making, all members of the Board of Executive Directors are authorized to make decisions individually in their designated areas of responsibility.

The Board of Executive Directors can set up Board committees to consult and decide on individual issues such as proposed material acquisition or divestiture projects or to prepare decisions to be made by the entire Board. These committees must include at least three members of the Board of Executive Directors. For the preparation of important decisions, such as those on acquisitions, divestitures, investments and personnel, the Board has various commissions at the level below the Board. With the support of the Corporate Center units and the service and research units and independently of the affected operating division, these committees thoroughly assess the planned measures and evaluate the associated opportunities and risks. Based on this information, they report and make recommendations to the Board.

The Board of Executive Directors informs the Supervisory Board regularly, without delay and comprehensively, of all issues important to the company with regard to planning, business development, the risk situation, control and risk management and compliance. Furthermore, the Board of Executive Directors coordinates the company’s strategic orientation with the Supervisory Board. The Statutes of BASF SE and the Supervisory Board have defined certain transactions that require the Board of Executive Directors to obtain the Supervisory Board’s approval prior to their conclusion. Such cases that require approval include the acquisition of enterprises and disposal of parts of enterprises, as well as the issue of bonds or comparable financial instruments if the acquisition or disposal price or the amount of the issue in an individual case exceeds 3% of the equity reported in the most recent approved Consolidated Financial Statements of the BASF Group.

The members of the Board of Executive Directors, including their areas of responsibility and memberships in the supervisory bodies of other companies, are listed here.

Competence profile, diversity concept and sucession planning for the Board of Executive Directors

The Supervisory Board works hand in hand with the Board of Executive Directors to ensure long-term succession planning for the composition of the Board of Executive Directors. BASF aims to fill most Board positions with leaders from within the company. It is the task of the Board of Executive Directors to propose a sufficient number of suitable individuals to the Supervisory Board.

Long-term succession planning is guided by the corporate strategy. It is based on systematic management development characterized by the following:

- Early identification of suitable leaders of different professional backgrounds, nationalities and genders

- Systematic development of leaders through the successful assumption of tasks with increasing responsibility, where possible in different business areas, regions and functions

- Desire to shape strategic and operational decisions and proven success in doing so, as well as leadership skills, especially under challenging business conditions

- Role model function in putting corporate values into practice

The aim of systematic management development is to enable the Supervisory Board to ensure a reasonable level of diversity with respect to education and professional experience, cultural background, international representation, gender and age when appointing members of the Board of Executive Directors. Irrespective of these individual criteria, a holistic approach will determine a person’s suitability for appointment to the Board of Executive Directors of BASF SE. Both systematic succession planning and the selection process aim to ensure that the Board of Executive Directors as a whole has the following profile, which serves as a diversity concept:

- Many years of leadership experience in scientific, technical and commercial fields

- International experience based on background and/or professional experience

- At least one female Board member

- A balanced age distribution to ensure the continuity of the Board’s work and enable seamless succession planning

The first appointment of members of the Board of Executive Directors is for a term of no more than three years. The standard age limit for members of the Board of Executive Directors is 63. The Supervisory Board determines the number of members on the Board of Executive Directors. It is guided by the requirements of the corporate structure of the BASF Group and by the needs arising from cooperation within the Board of Executive Directors. The Supervisory Board considers an expansion of the Board of Executive Directors from six to seven members in the coming business year to be appropriate given the current and future business composition, future development tasks and adjustment of the fundamental organizational structure of the BASF Group.

Implementation of the competence profile and the diversity concept for the Board of Executive Directors

Supervision of company management by the Supervisory Board

The Supervisory Board appoints the members of the Board of Executive Directors. It supervises and advises the Board of Executive Directors on management issues and is also involved in making decisions that are of key importance for the company. This also includes the Board of Executive Directors’ consideration of sustainability issues with regard to corporate management. The Supervisory Board is also responsible for auditing BASF SE’s and the BASF Group’s Annual Financial Statements.

As members of the Supervisory Board may not simultaneously be on the Board of Executive Directors, a high level of independence is already structurally ensured with regard to the supervision of the Board of Executive Directors. In addition to the SE Regulation and the SE Implementation Act, the relevant legal basis for the size and composition of the Supervisory Board is provided by the Statutes of BASF SE and the Agreement Concerning the Involvement of Employees in BASF SE (Employee Participation Agreement). The latter also includes the regulations applicable to BASF for implementing the statutory gender quota for the Supervisory Board. The German Co-determination Act does not apply to BASF SE as a European stock corporation (Societas Europaea, SE).

The Supervisory Board of BASF SE has twelve members and is composed on the basis of equal representation: Half of the members are elected by the shareholders at the Annual Shareholders’ Meeting via a simple majority and the other half are elected by the BASF Europa Betriebsrat (BASF Works Council Europe), the European employee representation body of the BASF Group. Members of the Supervisory Board are appointed for a term of four years. This ensures that the maximum membership duration of 12 years up to which a Supervisory Board member can be classified as independent in accordance with the GCGC corresponds to a total of three election terms.

Meetings of the Supervisory Board and its four committees are regularly convened by their respective chairs. Independently, meetings may also be convened at the request of a member of the Supervisory Board, committee or Board of Executive Directors. The shareholder and employee representatives of the Supervisory Board prepare for Supervisory Board meetings in separate preliminary discussions. Resolutions of the Supervisory Board are passed by a simple majority vote of the participating Supervisory Board members. In the event of a tie, the vote of the Chairman of the Supervisory Board, who must always be a shareholder representative, gives the casting vote. This resolution process is also applicable for the appointment and dismissal of members of the Board of Executive Directors by the Supervisory Board. Resolutions can, as needed, also be made in writing or through electronic communication outside of the meetings. The Supervisory Board meets regularly even without the Board of Executive Directors.

The Board of Executive Directors continually informs the Supervisory Board about matters such as the course of business and expected developments, the results of operations, net assets and financial position, material acquisition and divestiture projects, corporate planning, the implementation of the corporate strategy, including the sustainability strategy, business opportunities and risks as well as risk and compliance management and the internal control system. The Supervisory Board has embedded the main reporting requirements in an information policy. The Chairman of the Supervisory Board is in regular contact with the Board of Executive Directors, especially with its Chairman, outside of meetings as well.

Competence profile, diversity concept, independence and further objectives for the composition of the Supervisory Board

One important concern of good corporate governance is to ensure that seats on the responsible corporate bodies, the Board of Executive Directors and the Supervisory Board are appropriately filled. In implementing the legal requirements and taking into account the recommendations of the GCGC, the Supervisory Board has therefore agreed on objectives for its composition, including a competence profile and diversity concept, and most recently updated these in December 2022. The guiding principle for the composition of the Supervisory Board is to ensure qualified supervision and guidance for the Board of Executive Directors of BASF SE. For the election of shareholder representatives to the Supervisory Board, individuals will only be nominated to the Annual Shareholders’ Meeting who can, based on their professional knowledge and experience, integrity, commitment, independence and character, successfully perform the work of a supervisory board member at an international chemical company.

Competence profile

The following requirements and objectives are considered essential to the composition of the Supervisory Board as a collective body:

- Leadership experience in managing companies, associations and networks

- Members’ collective knowledge of the chemical sector and the related value chains

- Appropriate knowledge within the body as a whole of finance, accounting, financial reporting, risk management, law and compliance

- Appropriate expertise within the body as a whole on sustainability issues relevant to BASF

- At least one member with special knowledge and experience (special expertise) in the field of accounting, including sustainability reporting

- At least one member with special knowledge and experience (special expertise) in the field of financial auditing, including the audit of sustainability reporting

- At least one member with in-depth experience in innovation, research and development, and technology

- At least one member with in-depth experience in the areas of digitalization, information technology, business models and startups

- At least one member with in-depth experience in the areas of human resources, society, communications and the media

- Specialist knowledge and experience in sectors outside of the chemical industry

Diversity concept

The Supervisory Board strives to achieve a reasonable level of diversity with respect to character, gender, international representation, professional background, specialist knowledge and experience as well as age distribution. It takes the following composition criteria into account:

- At least 30% of members are women and 30% of members are men.

- At least 30% of members with international experience based on their background or professional experience

- At least 50% of members with different educational backgrounds and professional experience

- At least 30% of members are under the age of 60.

Independence

To ensure the independent monitoring and consultation of the Board of Executive Directors, the Supervisory Board should have an appropriate number of independent members on the Board as a whole and an appropriate number of independent shareholder representatives. The Supervisory Board deems this to be the case if more than half of the shareholder representatives and at least eight members of the Supervisory Board as a whole can be considered independent. In assessing independence, the Supervisory Board follows the assessment criteria of the current GCGC in conjunction with the provisions of Delegated Regulation (EU) 2023/2772.

According to these criteria, indicators of a lack of independence of a Supervisory Board member are:

- Membership of the Board of Executive Directors of the company in the two years prior to being appointed to the Supervisory Board

- Significant business relations with the company or an entity dependent on the company (such as a customer, supplier, lender or adviser), either currently or in the year prior to their appointment, either directly or as a shareholder of, or in a responsible position at, a third-party company

- Close family relations with a member of the Board of Executive Directors

- Membership of the Supervisory Board for more than 12 years.

The Supervisory Board has additionally defined the following principles to clarify the meaning of independence:

- The independence of employee representatives is not compromised by their role as an employee representative or employment by BASF SE or a Group company.

- Prior membership of the Board of Executive Directors of BASF SE does not preclude independence following the expiry of the statutory cooling-off period of two years.

- Material transactions between a Supervisory Board member or a related party or undertaking of the Supervisory Board member on the one hand, and BASF SE or a BASF Group company on the other, exclude a member of the Supervisory Board from being qualified as independent. A material transaction is defined as one or more transactions in a single calendar year with a total volume of 1% or more of the sales of the companies involved in each case.

- If a Supervisory Board member or a related party or undertaking of a Supervisory Board member has a personal service or consulting agreement with BASF SE or one of its Group companies with an annual compensation of over 50% of the Supervisory Board compensation, they do not qualify as independent.

- Furthermore, if a Supervisory Board member or a related party of a Supervisory Board member holds more than 20% of the shares in a company in which BASF SE is indirectly or directly the majority shareholder, the necessary independence is also not met.

The assessment criteria for independence of the GCGC and the Supervisory Board’s own principles to clarify the meaning of independence are worded with greater differentiation than the provisions of Delegated Regulation (EU) 2023/2772. Consequently, according to both standards, the majority of Supervisory Board members do not have any interests, positions, associations or relations that, from the perspective of a reasonable and informed third party, are conducive to exerting undue influence on decision-making or to causing bias.

Further objectives for the composition of the Supervisory Board

- Character and integrity: Members of the Supervisory Board must be personally reliable and have the knowledge and experience required to diligently and independently perform the work of a Supervisory Board member.

- Availability: Each member of the Supervisory Board ensures that they invest the time needed to properly perform their role as a member of the Supervisory Board of BASF SE. The statutory limits on appointments and the recommendations of the GCGC must be complied with when accepting further appointments.

- No conflicts of interest: Persons who may be subject to a conflict of interest may not be nominated for election to the Supervisory Board. A conflict of interest is deemed to be any personal interest, or third-party interest relevant to the nominated person, that, on account of its duration or intensity, gives cause for concern that the business interests of BASF will be impaired or jeopardized.

- Age limit and period of membership: Persons who have reached the age of 72 on the day of election by the Annual Shareholders’ Meeting should generally not be nominated for election. Membership on the Supervisory Board should generally not exceed three regular statutory periods in office, which corresponds to 12 years.

Implementation of the competence profile, diversity concept, independence requirements and further objectives for the composition of the Supervisory Board

According to the Supervisory Board’s own assessment, its current composition meets all of the requirements of the competence profile: Every single area of competence is covered by several members of the Supervisory Board. In particular, the in-depth knowledge and experience of the chemical sector and the related value chains, which are crucial for understanding the business activities of BASF, are broadly represented. It also has the essential knowledge of accounting, financial reporting and auditing, including sustainability reporting and its auditing, required for monitoring the management of the company.

According to the Supervisory Board’s own assessment, its current composition also meets all of the independence requirements in full: Eleven of the 12 current members, of which six are shareholder representatives and five are employee representatives, are considered independent based on the above criteria. Only the employee representative Michael Vassiliadis is no longer considered independent as he has been a member of the Supervisory Board since August 2004, and therefore for over 12 years.

The Supervisory Board also meets the required composition criteria under the diversity concept in full:

| Dec. 31, 2025 | Dec. 31, 2024 | |

| Proportion of women | 33.3% | 33.3% |

| Proportion of members with international experience based on their background or professional experience | 50% | 50% |

| Proportion of members with different educational backgrounds and professional experience | 66.7% | 66.7% |

| Proportion of members under 60 years of age | 58.3% | 66.7% |

| Proportion of independent members in accordance with GCGC | 91.7% | 91.7% |

| Proportion of independent members in accordance with Delegated Regulation (EU) 2023/2772 | 100% | 100% |

Compensation of the Board of Executive Directors and Supervisory Board

Compensation of the Board of Executive Directors is based on the size, complexity and economic position of the company. The structure of this compensation is designed to contribute to sustainable business success and the achievement of strategic corporate targets. The amount of the variable compensation is derived both from the achievement of short- and long-term financial and sustainabilityrelated targets and from the development of the share price and dividend per share (total shareholder return). Since the 2024 business year, the short-term incentive (STI) has accounted for 25% and the long-term incentive (LTI) for 41% of the total target compensation for a business year.

In addition to three financial targets, which account for a total of 75% of the STI, the STI for the 2025 business year also defines the following targets1, the first two of which relate to sustainability: employee engagement (Engagement Index), occupational and process safety and strategic projects. All three of these targets are equally weighted in the STI and together account for 25% of the total STI formula. This means that 16.7% of the entire STI formula is sustainability-related. The LTI includes the reduction of CO2 emissions (Scope 1 and 2) of the BASF Group as one of three equally weighted (33.3%2) strategic goals. These have been anchored as the most important nonfinancial key performance indicator in the BASF Group’s steering and compensation systems since 2020. The sustainability-related performance of the BASF Group is thus included in the compensation of the Board of Executive Directors.

The compensation of the Supervisory Board does not include any variable components and is therefore not tied to the achievement of targets.

The structure and amount of compensation for the Board of Executive Directors are set by the Supervisory Board at the recommendation of the Personnel Committee. In the event of significant changes, but at least every four years, the compensation system determined by the Supervisory Board is submitted to the Annual Shareholders’ Meeting for approval. Compensation for Supervisory Board members is governed by the Statutes of BASF SE, which are decided upon by the Annual Shareholders’ Meeting (legally required by sections 87 and 87a AktG for the Board of Executive Directors and section 113 AktG for the Supervisory Board).

The Compensation Report in accordance with section 162 of the German Stock Corporation Act (AktG) together with the assurance statement of the substantive and formal audit issued by the auditor and the compensation system for the Board of Executive Directors will be publicly available on the BASF website.

2 The exact percentage influence on compensation depends on target achievement. For more information, see the Compensation Report, which will be published at basf.com/compensationreport.

The Board of Executive Directors’ and the Supervisory Board’s Handling of Sustainability Topics

Organization and responsibilities for monitoring sustainability-related impacts, risks and opportunities

Sustainability is systematically incorporated within the strategy, operations and assessment, steering and compensation systems of BASF.

Risk management and the internal control system are the responsibility of the entire Board of Executive Directors, which defines the basic requirements and processes as well as the organization of the risk management system. The Board of Executive Directors also defines the processes for approving investments, acquisitions and divestitures. It is supported by the units of the Corporate Center. Global opportunity and risk management falls under the responsibility of the Corporate Finance unit, which reports to the Chief Financial Officer, and systematically records sustainability-related opportunities and risks. Sustainability-related impacts on the business are analyzed by the Corporate Sustainability unit, which is part of Corporate Development. Corporate Development reports to the Chairman of the Board of Executive Directors. Decisions regarding investments, acquisitions and divestitures take into account comprehensive assessments of sustainability impacts. The Risk Committee, which comprises representatives from various Corporate Center units, reviews the Group-wide risk profile and any necessary adjustments to measures at least twice a year and informs the Board of Executive Directors accordingly. The Corporate Audit unit regularly audits the effectiveness and appropriateness of the risk management system, internal control system and the compliance management system and reports to the Board of Executive Directors and the Supervisory Board on these matters.

The supervisory and advisory activities of the entire Supervisory Board also include the Board of Executive Directors’ consideration of sustainability topics with regard to corporate management and strategy development. Supervision of the risk management system and the internal control system, the internal auditing system, the appropriateness and effectiveness of the compliance management system, and compliance with statutory provisions and internal health, safety and environmental regulations falls within the responsibility of the Audit Committee. The Audit Committee also deals with follow-up assessments of key acquisition and investment projects. The Audit Committee also monitors sustainability reporting and its auditing as part of its supervision of accounting and auditing.

As part of the development of the corporate strategy communicated in September 2024, the Board of Executive Directors identified the transformation of the BASF Group toward a more sustainable portfolio as a strategic lever to enable the green transformation of BASF’s customers as their preferred chemical company. The Strategy Committee of the Supervisory Board was closely involved in developing this strategy and in the decision-making process. In 2025, the Supervisory Board as a whole was regularly informed of the status of implementation.

Sustainability topics are discussed regularly and managed collectively by the Board of Executive Directors. When making its decisions, the Board of Executive Directors continuously considers the results and recommendations from sustainability evaluations of business processes. It makes decisions with strategic relevance for the Group and monitors the implementation of strategic plans and their target achievement. The Supervisory Board is regularly briefed by the Board of Executive Directors on the development of individual sustainability topics, on sustainability targets and the status of target achievement.

If potential negative impacts are identified, for example, in planned investments, these are presented transparently in the internal decision-making process together with possible mitigation measures. In the business year under review, the Board of Executive Directors therefore again took appropriate and careful account of compromises developed in connection with the impacts, risks and opportunities of significant transactions and the risk management process, and discussed these compromises with the Supervisory Board.

Pursuant to the Statutes of the company and the Rules of Procedure of the Supervisory Board, investment, acquisition and divestiture decisions of the Board of Executive Directors, the commencement of new business areas and the discontinuation of existing ones require the consent of the Supervisory Board insofar as they are of material significance for the Group as a whole. The Supervisory Board is thus always involved comprehensively and at an early stage in the aforementioned evaluation of sustainability criteria in connection with strategic decisions of the Board of Executive Directors.

In order to achieve the sustainability targets and implement the measures contributing to them, appropriate organizational structures have been put into place: Together with specialists from operating divisions and service units, the various Corporate Center units are responsible for integrating the sustainability targets into decision-making processes as well as for corresponding management and reporting. The Corporate Environmental Protection, Health, Safety & Quality unit, which reports to the Industrial Relations Director, and thus to a member of the Board of Executive Directors, develops Groupwide requirements and guidelines for collecting emissions and energy data, for energy management and for occupational safety and health. The unit conducts regular audits to monitor the implementation of and compliance with internal and legal requirements by the BASF sites and Group companies. In her role as Chief Compliance Officer (CCO), the head of the Legal and Compliance organization manages the development and implementation of the compliance management system and reports directly to the Chairman of the Board of Executive Directors. She is supported in this by compliance officers worldwide. The Corporate Sustainability unit is responsible for the global steering of the sustainability portfolio, CO2 management and the circular economy concept, as well as the development of appropriate levers for achieving targets. The Global Procurement unit, together with Corporate Sustainability, is responsible for purchasing processes and procurement requirements with regard to our raw materials-related targets. Global Procurement reports to the Chief Financial Officer. Once a year, the Board of Executive Directors reports in detail to the Supervisory Board on the sustainability targets and the status of target achievement. Group-wide CO2 emissions (Scope 1 and Scope 2) have also been anchored in the BASF Group’s steering and compensation systems as the most important nonfinancial key performance indicators since 2020.

Information of the Board of Executive Directors and the Supervisory Board on sustainability aspects

The Board of Executive Directors and Supervisory Board are regularly briefed on sustainability aspects, including the process of the double materiality assessment and its findings. Corporate Finance provides the Board of Executive Directors twice a year with information on the aggregated opportunity/risk exposure of the BASF Group. New individual risks with an impact of €10 million or more on earnings, as well as risks with significant impacts on the sustainability targets and reputation of BASF must be reported directly to the responsible member of the Board of Executive Directors and the Chief Financial Officer. The Audit Committee is informed annually about short-term operational opportunities and risks as well as the risk management system and its further development, and reports on these matters to the entire Supervisory Board. The Corporate Development unit addresses strategic opportunities and risks annually to the Board of Executive Directors and Supervisory Board. Furthermore, the Board of Executive Directors reports to the Supervisory Board once a year on the achievement of the sustainability targets and the effectiveness of the strategies, measures and parameters decided upon.

The Corporate Audit unit is responsible for regularly auditing the effectiveness and appropriateness of the risk management system, the internal control system and the compliance management system. It reports to the Audit Committee on these matters each year. The Audit Committee addresses the effectiveness and appropriateness of these systems as part of its monitoring activities.

The Board of Executive Directors and the Supervisory Board are regularly informed about the implementation of due diligence: At the beginning of each business year, the CCO and the head of the Corporate Compliance unit report in detail to the Board of Executive Directors on compliance, including human rights issues, as well as on initiatives and the organizational development of Corporate Compliance. In addition, the head of the Corporate Compliance unit reports to the Audit Committee twice a year. The Corporate Center unit Corporate Environmental Protection, Health, Safety & Quality reports to the Board of Executive Directors at the beginning of each business year on the Responsible Care audits conducted in the previous year, as well as on the audit planning for the current year. Once a year, the Chief Financial Officer reports to the Audit Committee on the Responsible Care audits conducted in the areas of environmental protection, health and safety in the previous business year, as well as on the audit planning for the current year.

The Board of Executive Directors and Supervisory Board dealt with the following material impacts, risks and opportunities of BASF during the reporting period:

| ESRS standard | Material impacts, risks, opportunities | Handled by the Board of Executive Directors |

Handled by the Supervisory Board | Handled by the Audit Committee |

|---|---|---|---|---|

| Environment | ||||

| Climate Change | Climate change mitigation | ✓ | ✓ | |

| Energy | ✓ | ✓ | ||

| Pollution Prevention | Water pollution | ✓ | ✓ | |

| Resource Use and Circular Economy | Resource inflows including resource utilization | ✓ | ✓ | |

| Waste | ✓ | |||

| Social | ||||

| Own Workforce | Secure employment | ✓ | ✓ | |

| Adequate wages | ✓ | |||

| Health and safety | ✓ | ✓ | ✓ | |

| Workers in the Value Chain | Health and safety | ✓ | ✓ | ✓ |

| Child labor | ✓ | ✓ | ||

| Forced labor | ✓ | ✓ | ||

| Affected Communities | Land-related impacts | ✓ | ✓ | |

| Other social and economic rights | ✓ | ✓ | ||

| Governance | ||||

| Business Conduct | Corporate culture | ✓ | ✓ | ✓ |

| Protection of whistleblowers | ✓ | ✓ | ✓ | |

|

Corruption and bribery (for example, prevention and detection including training, incidents) |

✓ | ✓ | ✓ | |

| Cross-thematic issues and other sustainability and risk management-related topics | ||||

| Nonfinancial short-term incentive (STI) targets and strategic longterm incentive (LTI) targets for 2025 | ✓ | ✓ | ||

| Sustainability targets and target achievement | ✓ | ✓ | ✓ | |

| Sustainability reporting 2024 | ✓ | ✓ | ✓ | |

| Double materiality assessment 2025 | ✓ | |||

| Risk management | ✓ | ✓ | ||

| Corporate Audit Activity Report 2024, Audit Planning 2025 | ✓ | ✓ | ||

| Appropriateness and effectiveness of the internal control system and risk management system | ✓ | ✓ | ||

Competence of the Board of Executive Directors and Supervisory Board in monitoring sustainability aspects

Sustainable and responsible behavior is firmly enshrined in BASF’s corporate purpose, strategy, objectives and business operations. For instance, BASF’s innovations, products and technologies help to use natural resources more efficiently, meet the demand for food, enable climate-friendly mobility, reduce emissions and waste, or increase the efficiency of renewable energy. At the same time, BASF causes CO2 emissions, uses water and sources raw materials from suppliers, which may involve a potential risk of violating environmental or labor standards. Sustainability thus represents a material topic that cuts across operating divisions and segments – and is dealt with by each member of the Board of Executive Directors within their respective area of divisional responsibility. Therefore, sustainabilityrelated expertise, particularly in relation to sustainability topics that are of material importance to BASF, is broadly anchored within the Board of Executive Directors.

The Board of Executive Directors possesses in-depth knowledge on the material topics of climate protection and energy as well as resource use and circular economy: Dr. Markus Kamieth, Michael Heinz, Dr. Stephan Kothrade and Dr. Katja Scharpwinkel were directly involved in a project that focused on the provision of renewable energy, avoiding and managing CO2 and safeguarding access to renewable raw materials. On account of his former position as a member of the Executive Board of Wintershall Holding GmbH and his current role on the Board of Harbour Energy plc, Dr. Dirk Elvermann possesses in-depth expertise in the energy sector. As Chief Financial Officer, he also deals intensively with sustainability reporting in accordance with CSRD requirements and is familiar with sustainable finance. On account of his many years of experience as the Site Director of the Nanjing Verbund site, Dr. Stephan Kothrade is familiar with climate-related topics at Verbund sites, as well as with the material sustainability topics of air and water pollution. Based on his career in the Catalysts division, Anup Kothari holds expertise in air pollution in addition to battery recycling and the responsible sourcing of raw materials. Thanks to Dr. Markus Kamieth, Dr. Dirk Elvermann, Michael Heinz and Industrial Relations Director Dr. Katja Scharpwinkel, the Board of Executive Directors has broad knowledge of health and safety at its disposal, both in relation to the company’s own workforce and the workers in the value chain, as well as the prevention of child and forced labor. By virtue of their many years of leadership experience within BASF, all members of the Board of Executive Directors are fully conversant with corporate governance, culture and policy, in particular in relation to the protection of whistleblowers and the prevention of corruption and bribery.

The Supervisory Board as a whole possesses a broad spectrum of sustainability-related expertise. Dr. Kurt Bock and Prof. Dr. Stefan Asenkerschbaumer have in-depth knowledge of corporate governance and corporate policy thanks to their decades of management experience. Thanks to his research activities in the field of organic chemistry, Prof. Dr. Thomas Carell is fully versed in the topic of substances of concern and substances of very high concern. Due to his former role in the chemical industry, Liming Chen possesses expertise in the areas of air and water pollution. On account of her previous position as chief financial officer of a publicly listed international company based in the EU, the Chairwoman of the Audit Committee, Alessandra Genco, is fully conversant with sustainability reporting and the CSRD requirements. She also boasts expertise in circular economy and recycling processes. In terms of the monitoring of sustainability aspects, Tamara Weinert contributes relevant expertise from her former management positions in the energy sector, which is important for BASF, and her operational and strategic management experience in the area of water withdrawals and consumption and in circular solutions. As part of their respective activities, all shareholder representatives on the Supervisory Board regularly deal with climate protection matters. Sinischa Horvat, Natalie Mühlenfeld and Michael Vassiliadis possess broad expertise in the field of health and safety, both in relation to the company’s own workforce and workers in the value chain. As part of their trade union and works council activities, all employee representatives on the Supervisory Board have been dealing intensively with the topics of adequate wages and secure employment for many years. In-depth expertise on the topic of training and skills development is available among both the shareholder representatives and employee representatives. Where necessary, the members of the Supervisory Board also have the option of consulting external experts on specific topics.

Commitments to promote the participation of women in leadership positions at BASF SE

The supervisory board of a publicly listed European stock corporation (SE) that is composed of the same number of shareholder and employee representatives must, according to section 17(2) of the SE Implementation Act, consist of at least 30% women and 30% men. Since the 2018 Annual Shareholders’ Meeting, the Supervisory Board of BASF SE comprises four women, of whom two are shareholder representatives and two are employee representatives, and eight men. The Supervisory Board’s composition meets the statutory requirements.

Following the entry into force of the Act to Supplement and Amend the Regulations on Equal Participation of Women and Men in Management Positions in the Private and Public Sector (FüPoG) on August 12, 2021, if the management board of a listed company consists of more than three persons, at least one woman and one man must be members of the management board (section 16(2) SE Implementation Act). BASF met this requirement in the reporting year. With Dr. Katja Scharpwinkel, there was one female Board member. With six members of the Board of Executive Directors, this corresponds to a 16.7 percentage of women.

In compliance with legal requirements of the FüPoG, the Board of Executive Directors decided on target figures for the proportion of women at the two management levels below the Board of Executive Directors of BASF SE. For the target-attainment period from January 1, 2022, to December 31, 2026, the Board of Executive Directors resolved as targets the quotas achieved as of December 31, 2021: 20.0% for the proportion of women in the management level directly below the Board and 23.2% for the level below that.

Shareholders’ rights

Shareholders exercise their rights of coadministration and supervision at the Annual Shareholders’ Meeting, which usually takes place within the first five months of the business year. The Annual Shareholders’ Meeting elects half of the members of the Supervisory Board (shareholder representatives) and, in particular, resolves on the formal discharge of the Board of Executive Directors and the Supervisory Board, the distribution of profits, capital measures, the authorization of share buybacks, changes to the Statutes and the selection of the auditor.

Each BASF SE share represents one vote. All of BASF SE’s shares are registered shares. Shareholders are obliged to have themselves entered with their shares into the company share register and to provide the information necessary for registration in the share register according to the German Stock Corporation Act (AktG). There are no registration restrictions and there is no limit to the number of shares that can be registered to one shareholder. Only the persons listed in the share register are entitled to vote as shareholders. Listed shareholders may exercise their voting rights at the Annual Shareholders’ Meeting either personally, through a representative of their choice, through absentee voting, or through a company-appointed proxy authorized by the shareholders to vote according to their instructions. At the Annual Shareholders’ Meeting 2025, voting rights could be exercised according to shareholders’ instructions by company-appointed proxies until the end of the voting process. There are neither voting caps to limit the number of votes a shareholder may cast nor special voting rights. BASF has fully implemented the principle of “one share, one vote.” All shareholders entered in the share register are entitled to participate in the Annual Shareholders’ Meetings, to have their say concerning any item on the agenda and to request information about company issues insofar as this is necessary to make an informed judgment about the item on the agenda under discussion. Registered shareholders are also entitled to file motions pertaining to proposals for resolutions made by the Board of Executive Directors and Supervisory Board at the Annual Shareholders’ Meeting and to contest resolutions of the meeting and have them evaluated for their lawfulness in court. Shareholders who hold at least €500,000 of the company’s share capital, a quota corresponding to 390,625 shares, are furthermore entitled to request that additional items be added to the agenda of the Annual Shareholders’ Meeting.

The 2023 Annual Shareholders’ Meeting resolved a series of amendments to the Statutes in connection with the format of the Annual Shareholders’ Meeting and the participation options. Accordingly, the Board of Executive Directors is authorized to hold the Annual Shareholders’ Meeting or an Extraordinary Shareholders’ Meeting as a virtual meeting without the physical presence of shareholders or their proxies at the venue of the meeting. The 2025 Annual Shareholders’ Meeting renewed this authorization, which expired on May 8, 2025. It is now valid for a further period of two years until May 8, 2027.

The 2025 Annual Shareholders’ Meeting was held as a virtual Annual Shareholders’ Meeting on the basis of the authorization passed in 2023 pursuant to section 118a of the German Stock Corporation Act in conjunction with section 17(5) of the Statutes. The Annual Shareholders’ Meeting for 2026 is planned as an in-person Annual Shareholders’ Meeting.