Factbook

Investments and Portfolio Measures

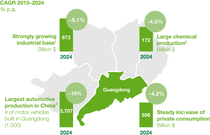

Portfolio management is an important part of our strategy, and investments remain a key driver of our targeted profitable growth as well as our green transformation. Our focus is on high-growth markets. The establishment of a new Verbund site in Zhanjiang, China, which we have designed from the outset as a lighthouse project for sustainability, contributes to achieving these aims.

The primary aim of our portfolio measures and investments is to strengthen the core businesses and unlock the value of the standalone businesses. Investing in our plants is essential to achieve the profitable growth we strive for in our core businesses. We invest in new technologies in order to facilitate our own green transformation and that of our customers. At the same time, we are taking measures to increase the efficiency of existing production processes and therefore to improve the profitability and competitiveness of our operations. For the period from 2025 to 2028, we are planning capital expenditures (capex)1 totaling around €16 billion, including approximately €3 billion for the establishment of our Verbund site in Zhanjiang, China. Due to the investments in the Verbund site in Zhanjiang, our capex peaked at around €6 billion in 2024. We anticipate a slight decrease to around €5 billion for 2025. Starting in 2026, we are planning to reduce capex to well below the level of depreciation and amortization.

1 Additions to property, plant and equipment excluding acquisitions, restoration obligations, IT investments and right-of-use assets arising from leases