Investors

Dividend

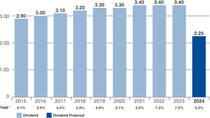

Dividend of EUR 2.25 per share

As part of its new strategy, BASF continues to offer its shareholders an attractive dividend yield. In the medium term, we are committed to keeping the overall distribution to shareholders at least at prior-year levels through a combination of dividends and share buybacks. We have set ourselves the target of distributing at least €12 billion to shareholders from 2025 to 2028. Specifically, we strive to pay out a dividend of at least €2.25 per share annually or distribute around €2 billion per year to our shareholders.

On May 2, 2025, the Annual Shareholders’ Meeting of BASF SE approved to pay a dividend of €2.25 per share. The dividend was paid out to shareholders on May 7, 2025.

Shareholder distribution policy

Shareholder distributions via dividends and share buybacks 2025-2028:

Overall distribution on the level of the last years

Paying agent within the meaning of sec. 48 (1) nr. 4 German Security Trading Act (WpHG) is the Deutsche Bank AG with its branches.

| For Fiscal year | Dividend (Million €) | Dividend / share1 (€) | Year-end share price1 (€) | Dividend yield (%) | Number of shares as of Dec. 311 (in thousands) |

| 2024 | 2,008 | 2.25 | 42.46 | 5.3 | 892.522 |

| 2023 | 3,035 | 3.40 | 48.78 | 7.0 | 892,522 |

| 2022 | 3,039 | 3.40 | 46.39 | 7.3 | 893,854 |

| 2021 | 3,072 | 3.40 | 61.78 | 5.5 | 918,478 |

| 2020 | 3,031 | 3.30 | 64.72 | 5.1 | 918,478 |

| 2019 | 3,031 | 3.30 | 67.35 | 4.9 | 918,478 |

| 2018 | 2,939 | 3.20 | 60.40 | 5.3 | 918,478 |

| 2017 | 2,847 | 3.10 | 91.74 | 3,4 | 918,478 |

| 2016 | 2,755 | 3.00 | 88.31 | 3.4 | 918,478 |

| 2015 | 2,664 | 2.90 | 70.72 | 4.1 | 918,478 |

| 2014 | 2,572 | 2.80 | 69.88 | 4.0 | 918,478 |

| 2013 | 2,480 | 2.70 | 77.49 | 3.5 | 918,478 |

| 2012 | 2,388 | 2.60 | 71.15 | 3.7 | 918,478 |

| 2011 | 2,296 | 2.50 | 53.89 | 4.6 | 918,478 |

| 2010 | 2,021 | 2.20 | 59.70 | 3.7 | 918,478 |

| 2009 | 1,561 | 1.70 | 43.46 | 3.9 | 918,478 |

| 2008 | 1,791 | 1.95 | 27.73 | 7.0 | 918,478 |

| 2007 | 1,831 | 1.95 | 50.71 | 3.9 | 956,370 |

| 2006 | 1,484 | 1.50 | 36.93 | 4.1 | 999,360 |

| 2005 | 1,015 | 1.00 | 32.36 | 3.1 | 1,030,118 |

| 2004 | 904 | 0.85 | 26.50 | 3.2 | 1,082,480 |

| 2003 | 774 | 0.70 | 22.29 | 3.1 | 1,113,286 |

| 2002 | 789 | 0.70 | 18.04 | 3.9 | 1,140,632 |

| 2001 | 758 | 0.65 | 20.88 | 3.1 | 1,166,802 |

| 2000 | 1,214 | 0.65 | 24.09 | 4.2 | 1,214,798 |

| +0.352 | |||||

|

1 Adjusted for 1:2 stock split in June 2008 2 Special dividend |

|||||

| For Fiscal year | Gross dividends | Payments on dividend warrant |

Payable as of |

Date of Annual Meeting |

| € | No. | |||

| 2024 | 2.25 | - | 05/07/2025 | 05/02/2025 |

| 2023 | 3.40 | - | 04/30/2024 | 04/25/2024 |

| 2022 | 3.40 | - | 05/03/2023 | 04/27/2023 |

| 2021 | 3.40 | - | 05/04/2022 | 04/29/2022 |

| 2020 | 3.30 | - | 05/04/2021 | 04/29/2021 |

| 2019 | 3.30 | - | 06/23/2020 | 06/18/2020 |

| 2018 | 3.20 | - | 05/08/2019 | 05/03/2019 |

| 2017 | 3.10 | - | 05/09/2018 | 05/04/2018 |

| 2016 | 3.00 | - | 05/17/2017 | 05/12/2017 |

| 2015 | 2.90 | - | 05/02/2016 | 04/29/2016 |

| 2014 | 2.80 | - | 05/04/2015 | 04/30/2015 |

| 2013 | 2.70 | - | 05/05/2014 | 05/02/2014 |

| 2012 | 2.60 | - | 04/29/2013 | 04/26/2013 |

| 2011 | 2.50 | - | 04/30/2012 | 04/27/2012 |

| 2010 | 2.20 | - | 05/09/2011 | 05/06/2011 |

| 2009 | 1.70 | 04/30/2010 | 04/29/2010 | |

| 2008 | 1.95 | - | 05/04/2009 | 04/30/2009 |

| 1:2 stock split on 06/27/2008 | ||||

| 2007 | 3.90 | 26 | 04/25/2008 | 04/24/2008 |

| 2006 | 3.00 | 25 | 04/27/2007 | 04/26/2007 |

| 2005 | 2.00 | 24 | 05/05/2006 | 05/04/2006 |

| 2004 | 1.70 | 23 | 04/29/2005 | 04/28/2005 |

| 2003 | 1.40 | 22 | 04/30/2004 | 04/29/2004 |

| 2002 | 1.40 | 21 | 05/07/2003 | 05/06/2003 |

| 2001 | 1.30 | 20 | 05/02/2002 | 04/30/2002 |

| 2000 | 2.00 | 19 | 04/27/2001 | 04/26/2001 |

| 1999 | 1.13 | 18 | 04/28/2000 | 04/27/2000 |

| DM | No. | |||

| 1998 | 2.20 | 17 | 04/30/1999 | 04/29/1999 |

| Conversion of DM shares to no-par shares as of 07/06/1998 | ||||

| 1997 | 2.00 | 16 | 05/20/1998 | 05/19/1998 |

| 1996 | 1.70 | 15 | 05/16/1997 | 05/15/1997 |

| Introduction of the 5 DM share; conversion of per-share price from nom. DM 50 to nom. DM 5 as of 07/01/1996 |

||||

| 1995 | 14.00 | 14 | 05/10/1996 | 05/09/1996 |

| 1994 | 10.00 | 13 | 15/05/1995 | 05/11/1995 |

| 1993 | 8.00 | 12 | 04/29/1994 | 04/28/1994 |

| 1992 | 10.00 | 11 | 04/30/1993 | 04/29/1993 |

| 1991 | 12.00 | 10 | 05/04/1992 | 04/30/1992 |

| 1990 | 13.00 | 9 | 06/28/1991 | 06/27/1991 |