Media

1st Quarter 2016/Annual Shareholders’ Meeting

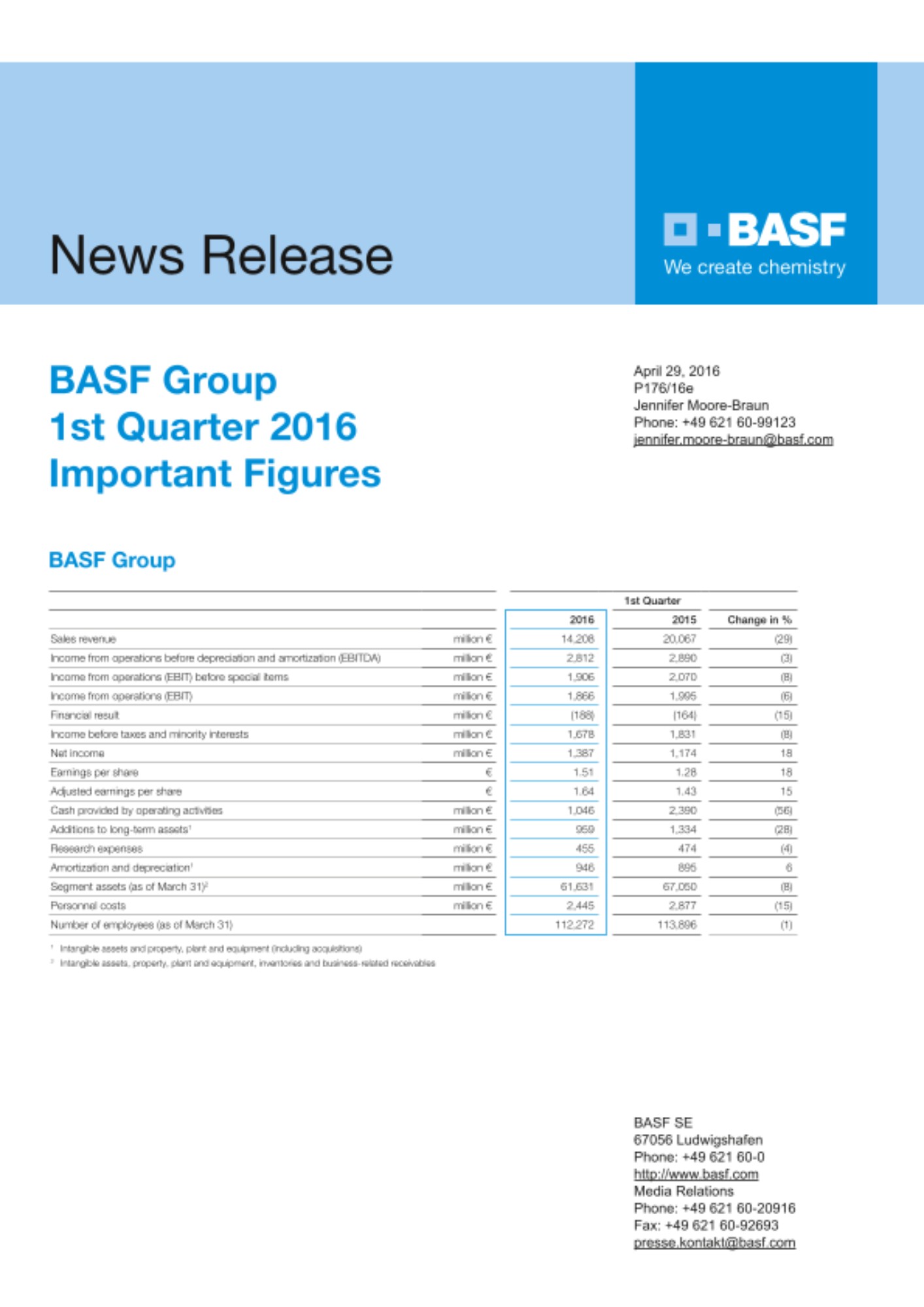

1st quarter 2016:

- Sales €14.2 billion (minus 29%)

- EBIT before special items €1.9 billion (minus 8%)

- Higher EBIT before special items in Performance Products, Functional Materials & Solutions and Agricultural Solutions

- Chemicals and Oil & Gas with considerably lower earnings

Outlook 2016 confirmed:

- Considerable sales decline due to divestiture of natural gas trading and storage business

- EBIT before special items expected at level slightly below 2015, based on an average oil price of $40 per barrel

Ludwigshafen, Germany – April 29, 2016 – In the first quarter of 2016, BASF Group sales decreased by 29% to €14.2 billion compared with the same quarter of the previous year. This was largely on account of the divestiture of the gas trading and storage business, which had contributed €4.2 billion to sales in the first quarter of 2015.

The lower price of oil led to declining sales prices, especially in the Chemicals segment. Overall sales volumes matched the level of the previous first quarter. Volumes increased slightly in the Functional Materials & Solutions, Oil & Gas and Performance Products segments, whereas they decreased slightly in the Agricultural Solutions and Chemicals segments.

“We were able to slightly increase EBIT before special items in the Performance Products, Functional Materials & Solutions and Agricultural Solutions segments,” said Dr. Kurt Bock, Chairman of the Board of Executive Directors, at the Annual Shareholders’ Meeting of BASF SE in the Congress Center Rosengarten in Mannheim, Germany. The significantly smaller contributions from the Oil & Gas and Chemicals segments reduced income from operations (EBIT) before special items by €164 million to €1.9 billion. A considerable earnings improvement in Other was especially the result of valuation effects for the long-term incentive program.

Compared with the previous first quarter, EBIT declined by €129 million to €1.9 billion. EBITDA fell by €78 million to €2.8 billion. At minus €188 million, the financial result was below the level of the first quarter of 2015 (minus €164 million).

Income before taxes and minority interests fell by €153 million to €1.7 billion. The tax rate was 15.4% (first quarter of 2015: 29.7%). The decline was mainly attributable to taxes in the Oil & Gas segment.

Net income rose by €213 million to €1.4 billion. Earnings per share were €1.51 in the first quarter of 2016, compared with €1.28 in the same period of 2015. Adjusted for special items and amortization of intangible assets, earnings per share amounted to €1.64 (first quarter of 2015: €1.43).

Dividend proposal of €2.90 per share

BASF stands by its ambitious dividend policy and proposes a dividend of €2.90 per share for the business year 2015 (previous year: €2.80). The company would thus pay out around €2.7 billion to its shareholders. “We aim to increase our dividend each year, or at least maintain it at the previous year’s level. Today’s dividend proposal at the Annual Shareholders’ Meeting also demonstrates our confidence in BASF’s future development – even with the knowledge that 2016 will not be an easy year either,” said Bock.

Outlook for 2016 confirmed

For 2016, BASF anticipates a continuation of the currently challenging conditions along with substantial risks. The expectations for the global economic environment in 2016 remain unchanged:

- Growth of gross domestic product: 2.3%

- Growth in global industrial production: 2.0%

- Growth in chemical production: 3.4%

- An average euro/dollar exchange rate of $1.10 per euro

- An average Brent blend oil price for the year of $40 per barrel

Bock: “We confirm our outlook for the full year: We aim to increase sales volumes in all segments. BASF Group sales will decline considerably, however, especially as a result of the divestiture of the gas trading and storage business as well as lower oil and gas prices. We expect EBIT before special items to be slightly below 2015 levels. This is an ambitious goal in the current volatile and challenging environment, and is particularly dependent on oil price developments.”

Focusing on high-growth businesses

“We will continue to refine our portfolio in 2016. Our goal is to concentrate on high-growth businesses,” said Bock. At the end of February, BASF reached an agreement with AkzoNobel to sell its industrial coatings business. This will enable BASF to focus even more on its core business with automotive coatings. In April, an agreement was signed to acquire the automotive refinishing business from Guangdong Yinfan Chemistry Co. Ltd., in China. The acquisition strengthens BASF’s position in the rapidly growing market for refinish coatings in China. Last week, BASF agreed to sell its polyolefin catalysts business to the U.S. company W.R. Grace & Co. With this divestiture, BASF will continue to sharpen its focus in the area of process catalysts on key growth areas, including the chemical catalysts and refinery catalysts businesses.

Business development in the segments in the first quarter 2016

Sales fell by 19% to €3.1 billion in the Chemicals segment, predominantly as a result of price drops brought about by the decline in raw material prices. Sales volumes decreased particularly in the Petrochemicals division in North America. At €465 million, EBIT before special items was down by €261 million compared with the first quarter of 2015, which had been marked by high margins. In addition to lower margins, this reduction was also attributable to increased fixed costs arising primarily from the startup of new plants in 2015.

Despite higher volumes, sales in the Performance Products segment were €3.8 billion, which was 6% below the level of the previous first quarter, largely on account of lower sales prices. The main factor here was the oil-price-related decline in raw material costs, although ongoing pressure on prices in the hygiene business was additionally responsible. Thanks to reduced fixed costs and higher volumes, EBIT before special items rose by €32 million to €547 million.

Sales in the Functional Materials & Solutions segment declined by 4% to €4.4 billion, mainly due to falling sales prices as a particular result of lower prices in precious metal trading. Sales volumes increased, particularly as a result of higher demand from the automotive and construction industries. Thanks to improved contributions from the Performance Materials and Construction Chemicals divisions, EBIT before special items grew by €25 million to €456 million.

In a market environment that remains difficult, sales in the Agricultural Solutions segment declined by 6% to €1.8 billion. Price increases were unable to compensate for lower sales volumes and negative currency effects. EBIT before special items improved by €17 million to €591 million. Margins rose, partly as a result of higher prices, and fixed costs were reduced.

Sales in the Oil & Gas segment fell by 88% to €611 million. The asset swap completed with Gazprom in 2015 meant a lack of contributions from the natural gas trading and storage business in particular. Sales were additionally weighed down by the decline in oil and gas prices. Production volumes increased, especially in Norway. EBIT before special items declined by €371 million to €66 million.

At €477 million, sales in Other were down 31% compared with the previous first quarter. Lower prices and volumes in the raw materials trading business were largely responsible, along with the expiration of supply contracts at the end of 2015 in connection with the disposal of the company’s share in the Ellba Eastern Private Ltd. joint operation in Singapore at the end of 2014. EBIT before special items improved by €394 million to minus €219 million, especially through valuation effects from the long-term incentive program. The increase was also supported by a positive currency result.

About BASF

At BASF, we create chemistry for a sustainable future. We combine economic success with environmental protection and social responsibility. The approximately 112,000 employees in the BASF Group work on contributing to the success of our customers in nearly all sectors and almost every country in the world. Our portfolio is organized into five segments: Chemicals, Performance Products, Functional Materials & Solutions, Agricultural Solutions and Oil & Gas. BASF generated sales of more than €70 billion in 2015. BASF shares are traded on the stock exchanges in Frankfurt (BAS), London (BFA) and Zurich (AN). Further information at www.basf.com.

You can obtain further information from the internet at the following addresses:

| Interim Report (from 7:00 a.m. CEST) | |

| basf.com/interimreport | (English) |

| basf.com/zwischenbericht | (German) |

| News Release (from 7:00 a.m. CEST) | |

| basf.com/pressrelease | (English) |

| basf.com/pressemitteilungen | (German) |

| Live Transmission – Telephone Conference for analysts and investors (from 8:30 a.m. CEST) | |

| basf.com/share | (English) |

| basf.com/aktie | (German) |

| Live Transmission – Speech Dr. Kurt Bock (from 10:00 a.m. CEST) | |

| basf.com/shareholdermeeting | (English) |

| basf.com/hauptversammlung | (German) |

| Speech (from 10:30 a.m. CEST) | |

| basf.com/pcon | (English) |

| basf.com/pressekonferenz | (German) |

| Photos | |

| basf.com/pressphotos | (English) |

| basf.com/pressefotos | (German) |

Forward-looking statements

This release contains forward-looking statements. These statements are based on current estimates and projections of BASF management and currently available information. They are not guarantees of future performance, involve certain risks and uncertainties that are difficult to predict, and are based upon assumptions as to future events that may not be accurate. Many factors could cause the actual results, performance or achievements of BASF to be materially different from those that may be expressed or implied by such statements. BASF does not assume any obligation to update the forward-looking statements contained in this release.

P-16-175