Media

BASF Group in second quarter 2025:

Sales almost at prior-year quarter level on slight volume growth; EBITDA before special items slightly lower

- Higher earnings in Agricultural Solutions, Surface Technologies and Nutrition & Care; ongoing margin pressure in base chemicals businesses

- Adjusted outlook: EBITDA before special items now expected to be between €7.3 billion and €7.7 billion

- Annual Shareholders’ Meeting to be held in person in alternating years

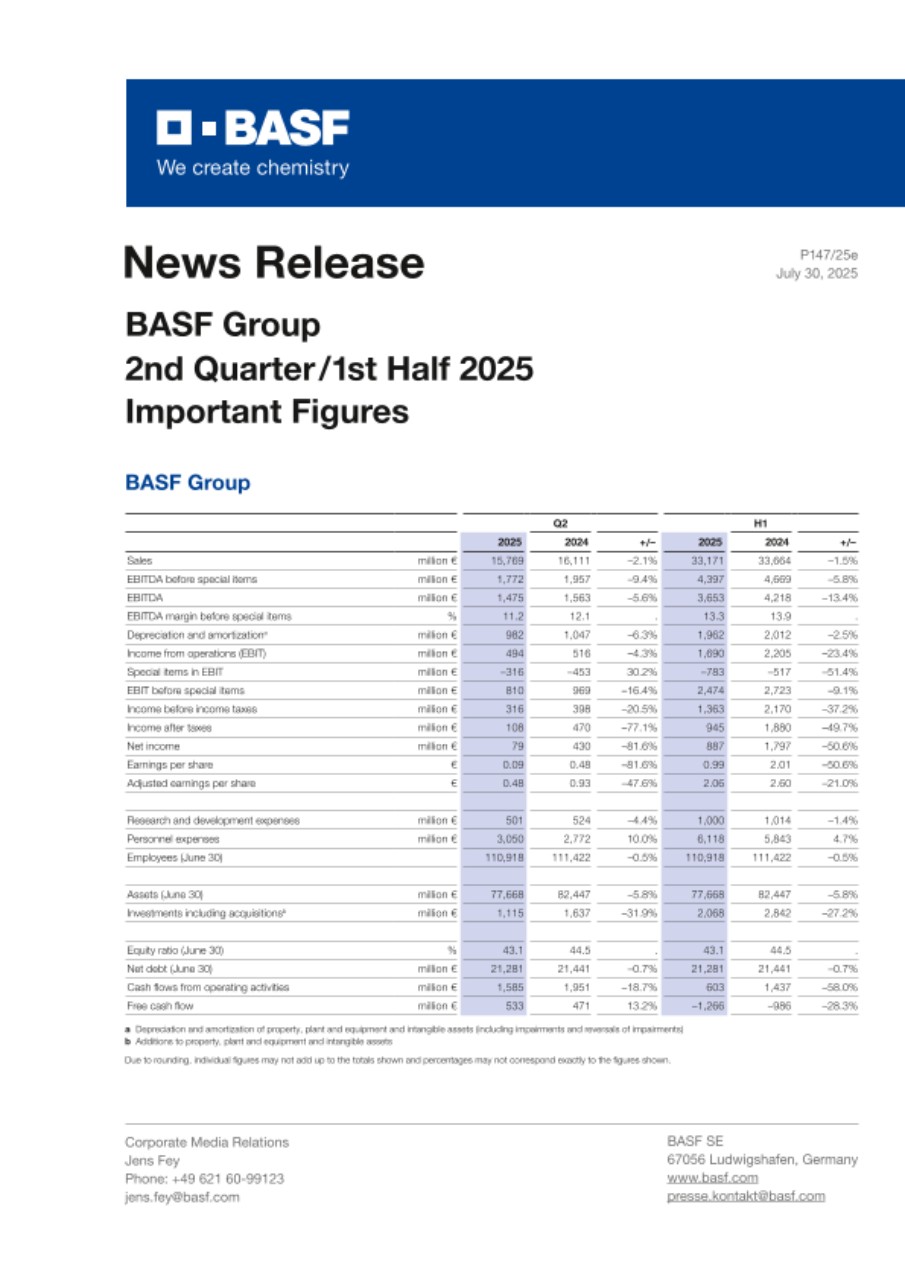

In the second quarter of 2025, BASF generated EBITDA before special items of around €1.8 billion. “The Agricultural Solutions segment recorded significantly higher earnings and achieved remarkable volume growth of 21 percent compared with the prior-year quarter,” said Dr. Markus Kamieth, Chairman of the Board of Executive Directors of BASF, presenting the quarterly figures together with Chief Financial Officer Dr. Dirk Elvermann. The Surface Technologies and Nutrition & Care segments achieved slightly higher earnings. In the base chemicals businesses, margins remained under pressure due to high product availability on the market.

BASF Group’s sales in the second quarter of 2025 amounted to €15.8 billion, €342 million below the level of the prior-year period. The main drivers of this development were negative currency effects as well as lower prices. The decline in prices was largely attributable to the Chemicals segment, whereas prices improved in the Surface Technologies and Nutrition & Care segments. Positive volume growth in the Agricultural Solutions, Surface Technologies and Materials segments partially offset the decline in sales.

Compared with the prior-year quarter, income from operations before depreciation, amortization and special items (EBITDA before special items) decreased by €185 million to €1.8 billion. This was mainly due to the considerable earnings decline in the Chemicals segment resulting largely from lower margins. The Industrial Solutions and Materials segments also recorded an earnings decline. By contrast, Agricultural Solutions in particular, but also Surface Technologies achieved earnings growth. The Nutrition & Care segment also recorded an earnings increase. EBITDA before special items in Other fell considerably compared with the prior-year quarter. The EBITDA margin before special items was 11.2 percent following 12.1 percent in the prior-year quarter.

EBITDA amounted to €1.5 billion following €1.6 billion in the prior-year period. In the second quarter of 2025, EBITDA included special items in the amount of minus €297 million. Special charges resulted primarily from structural measures in connection with cost saving programs. At €494 million, EBIT was €22 million below the prior-year quarter’s figure. The €112 million decline in net income from shareholdings was primarily due to negative earnings contributions from Wintershall Dea GmbH and Harbour Energy plc. The financial result improved by €52 million compared with the prior-year quarter to minus €106 million. Accordingly, income before income taxes amounted to €316 million, €82 million below the prior-year quarter’s figure. Net income was €79 million, compared with €430 million in the prior-year quarter.

Development of cash flows in the second quarter of 2025

Cash flows from operating activities totaled €1.6 billion in the second quarter, €365 million below the prior-year quarter’s figure. The main reason for the decrease was the change in trade accounts payable. Compared with the prior-year quarter, cash flows from investing activities improved considerably by €1.0 billion to minus €1.1 billion. This was primarily due to lower payments made for property, plant and equipment and intangible assets, which at €1.1 billion, were €428 million lower than in the prior-year quarter. “We have now passed the peak investment phase for our South China Verbund site and thus our cash performance will improve accordingly,” said Elvermann. Free cash flow, which is the cash flows from operating activities less payments made for property, plant and equipment and intangible assets, was €533 million in the second quarter of 2025, an increase of €62 million compared with the prior-year period.

BASF Group’s business development in the first half of 2025

Compared with the first half of 2024, BASF Group sales in the first half of 2025 decreased by €493 million to €33.2 billion. The decline was due to negative price developments in four of the six segments, particularly in the Chemicals segment. The Nutrition & Care and Surface Technologies segments recorded a rise in prices. Currencies developed negatively in all segments. Volumes rose, mainly in the Surface Technologies and Agricultural Solutions segments.

The BASF Group’s EBITDA before special items decreased by €272 million in the first half of 2025 and amounted to €4.4 billion. This was mainly attributable to declines in the Chemicals segment. EBITDA was €3.7 billion, compared with €4.2 billion in the prior-year period. At €1.7 billion, EBIT was down €515 million from the prior-year period. Net income was €887 million, compared with €1.8 billion in the prior-year period.

Development of cash flows in first half 2025

Cash flows from operating activities amounted to €603 million in the first half-year, €834 million below the prior-year period’s figure. Net cash outflow in cash flows from investing activities decreased considerably by €1.2 billion compared with the prior-year period to minus €1.8 billion. This was primarily due to the €554 million decrease in payments made for property, plant and equipment and intangible assets, especially in connection with construction of the Verbund site in Zhanjiang, China. Free cash flow was minus €1.3 billion in the first half of 2025, compared with minus €986 million in the prior-year period.

Format of Annual Shareholders’ Meeting to alternate annually

On the basis of the positive experience with the first virtual Annual Shareholders’ Meeting, BASF’s Board of Executive Directors decided to annually alternate the format of the Annual Shareholders’ Meeting of BASF SE over the next four years. The Annual Shareholders’ Meeting will be held in person again in 2026 and 2028. The proven virtual format will be used in 2027 and 2029. “This decision was made to meet the different expectations of our diversified investor base,” said Kamieth.

BASF Group outlook for 2025

Due to ongoing macroeconomic and geopolitical uncertainties, BASF has adjusted its assumptions for the full year 2025. According to current estimates, global gross domestic product will grow less rapidly in 2025 than previously expected. Growth is expected to weaken across all major economic regions in the second half of the year. Following the U.S. dollar’s significant depreciation against the euro, it is expected to remain at the same level as at the end of the first half of the year. Global industrial production will also see slowed growth according to current estimates. As a result, the rise in market demand for chemical products will not be as significant in 2025 as previously expected. Margins, particularly in the upstream sector, remain under pressure due to sustained high product availability in the market.

Accordingly, BASF has adjusted its assumptions regarding the global economic environment for 2025 as follows (previous assumptions from the BASF Report 2024 are in parentheses; current assumptions are rounded):

- Growth in gross domestic product: 2.0 percent to 2.5 percent (2.6 percent)

- Growth in industrial production: 1.8 percent to 2.3 percent (2.4 percent)

- Growth in chemical production: 2.5 percent to 3.0 percent (3.0 percent)

- Average euro/dollar exchange rate of $1.15 per euro ($1.05 per euro)

- Average annual oil price (Brent crude) of $70 per barrel ($75 per barrel)

The BASF Group’s forecast for the 2025 business year published in the BASF Report 2024 was also partially adjusted (previous forecast from the BASF Report 2024 is in parentheses if changed):

- EBITDA before special items of between €7.3 billion and €7.7 billion (€8.0 billion to €8.4 billion)

- Free cash flow of between €0.4 billion and €0.8 billion

- CO2 emissions of between 16.7 million metric tons and 17.7 million metric tons

The volatility of the tariff announcements and the unpredictability of other decisions by the United States government as well as possible countermeasures by trading partners are causing a high level of uncertainty. Thanks to our global strategy of serving customers through local production in their respective markets, the direct impact of the tariffs remains limited. However, there are indirect effects, particularly associated with demand for our products and their prices. This is mainly due to intensified competitive pressure and rising inflation. It is still not possible to fully assess the resulting effects.

About BASF

At BASF, we create chemistry for a sustainable future. Our ambition: We want to be the preferred chemical company to enable our customers’ green transformation. We combine economic success with environmental protection and social responsibility. Around 112,000 employees in the BASF Group contribute to the success of our customers in nearly all sectors and almost every country in the world. Our portfolio comprises, as core businesses, the segments Chemicals, Materials, Industrial Solutions, and Nutrition & Care; our standalone businesses are bundled in the segments Surface Technologies and Agricultural Solutions. BASF generated sales of €65.3 billion in 2024. BASF shares are traded on the stock exchange in Frankfurt (BAS) and as American Depositary Receipts (BASFY) in the United States. Further information at www.basf.com.

On July 30, 2025, you can obtain further information from the internet at the following addresses:

|

Half-Year Financial Report (from 7.00 a.m. CEST) |

|

|

(English) |

|

|

(German) |

|

|

News Release (from 7.00 a.m. CEST) |

|

|

(English) |

|

|

(German) |

|

|

Live Transmission – Telephone Conference for analysts and investors (from 8.30 a.m. CEST) |

|

|

(English) |

|

|

(German) |

|

|

Live Transmission – Press Conference (from 10.30 a.m. CEST) |

|

|

(English) |

|

|

(German) |

|

|

Speech (from 10.30 a.m. CEST) |

|

|

(English) |

|

|

(German) |

|

|

Photos |

|

|

(English) |

|

|

(German) |

|

|

Current TV footage |

|

|

(English) |

|

|

(German) |

|

Forward-looking statements and forecasts

This release contains forward-looking statements. These statements are based on current estimates and projections of the Board of Executive Directors and currently available information. Forward-looking statements are not guarantees of the future developments and results outlined therein. These are dependent on a number of factors; they involve various risks and uncertainties; and they are based on assumptions that may not prove to be accurate. BASF does not assume any obligation to update the forward-looking statements contained in this release above and beyond the legal requirements.

P-25-146