Media

BASF Group in third quarter 2025:

In a demanding environment, BASF achieves earnings slightly above market expectations and only slightly below Q3 2024

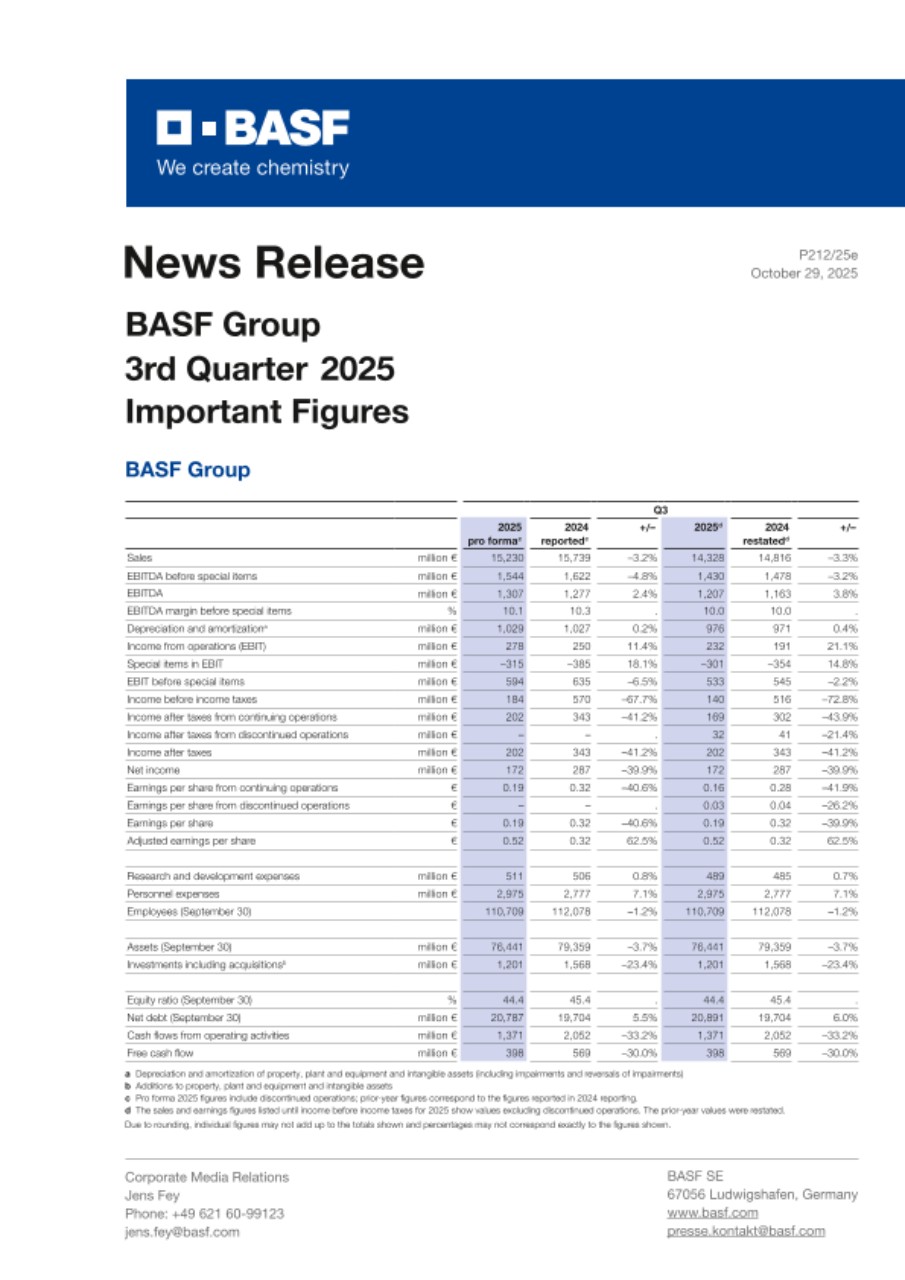

- Positive volume development outweighed by negative currency effects and lower prices: sales down 3% versus prior-year quarter

- EBITDA before special items in third quarter 2025 (including discontinued operations): €1.5 billion (Q3 2024: €1.6 billion)

The third quarter of 2025 was characterized by challenging market dynamics. “Customer buying behavior in almost all industries and regions remained cautious. Even in this demanding market environment, BASF’s earnings came in slightly above market expectations and only slightly below the level of the prior-year quarter,” said Dr. Markus Kamieth, Chairman of the Board of Executive Directors of BASF, when presenting the third-quarter figures together with Chief Financial Officer Dr. Dirk Elvermann. At €1.5 billion, BASF Group’s EBITDA before special items, including the discontinued coatings business, was down slightly by €78 million compared with the same quarter of the previous year.

Owing to the planned divestiture, the automotive OEM coatings, automotive refinish coatings and surface treatment businesses are reported as discontinued operations in accordance with IFRS 5 as of September 30, 2025. From this date, the sales and earnings of these business units are no longer part of the sales and EBIT(DA) of the BASF Group or the Surface Technologies segment. Retroactively to January 1, 2025, and until the transaction closes, the income after taxes of these business units is presented in the income after taxes of BASF Group as a separate item (“Income after taxes from discontinued operations”). The 2024 figures have been restated accordingly.

The Quarterly Statement published today presents the pro forma figures, including discontinued operations, as well as the restated figures in accordance with IFRS 5, excluding discontinued operations. The restated figures, which reflect the retroactive reclassification of the “Coatings” disposal group as discontinued operations, are explained in the following; the prior-year figures have been restated accordingly. In parentheses, the pro forma 2025 figures, including the discontinued operations, and the prior‑year figures reported in the 2024 reporting are shown but not further explained.

Sales amounted to €14.3 billion (Q3 2025 pro forma: €15.2 billion), slightly below the level of the prior-year period of €14.8 billion (Q3 2024 reported: €15.7 billion). The main reasons for this development were negative currency effects, primarily relating to the U.S. dollar, the Chinese renminbi and the Indian rupee, as well as lower prices. The Chemicals, Materials, Industrial Solutions and Agricultural Solutions segments saw price declines, whereas prices improved in the Surface Technologies and Nutrition & Care segments. Positive volume development in the Surface Technologies, Chemicals and Materials segments could partially offset the decline in sales.

EBITDA before special items, excluding discontinued operations, decreased slightly compared with the prior-year quarter from €1.5 billion (Q3 2024 reported: €1.6 billion) to €1.4 billion (Q3 2025 pro forma: €1.5 billion) as a result of lower earnings in the Industrial Solutions, Chemicals, Materials and Nutrition & Care segments. The significant increase in earnings in the Surface Technologies and Agricultural Solutions segments could only partially offset the downward earnings development. Earnings in Other improved compared with the prior-year period. The EBITDA margin before special items matched the prior-year quarter’s level of 10 percent.

EBITDA amounted to €1.2 billion (Q3 2025 pro forma: €1.3 billion), compared with almost €1.2 billion (Q3 2024 reported: almost €1.3 billion) in the prior-year period. EBITDA included special items totaling minus €0.2 billion. These resulted primarily from special charges relating to structural measures, particularly in connection with ongoing cost saving programs. Moreover, special income resulted from the divestiture of the food and health performance ingredients business in the Nutrition & Health division. At €232 million (Q3 2025 pro forma: €278 million), EBIT was above the prior-year quarter’s figure of €191 million (Q3 2024 reported: €250 million).

Net income – excluding and including discontinued operations – was €172 million, compared with €287 million in the prior-year quarter. In the third quarter of 2024, net income contained special income in connection with the transfer of Wintershall Dea assets to Harbour Energy plc, London, United Kingdom. Earnings per share amounted to €0.19 in the third quarter of 2025 (prior-year quarter: €0.32). Earnings per share adjusted for special items and amortization of intangible assets were €0.52 (prior-year quarter: €0.32).

Cash flows from operating activities totaled €1.4 billion in the third quarter, €681 million below the level of the prior-year quarter. The decrease was primarily attributable to changes in other operating assets. At €973 million, payments made for intangible assets and property, plant and equipment were lower by €510 million. Free cash flow amounted to €398 million in the third quarter of 2025, down by €171 million compared with the prior-year period.

BASF to begin share buyback program in November 2025

The agreement reached with Carlyle in October 2025 marks an important milestone in focusing BASF’s portfolio and unlocking the value of the coatings business. It demonstrates that BASF is swiftly executing its “Winning Ways” strategy.

In view of cash proceeds already received and further proceeds expected, particularly from portfolio measures, BASF will start a share buyback program, as already announced yesterday. The program, which has a volume of up to €1.5 billion, is scheduled to start in November 2025 and be concluded by the end of June 2026. It is part of the share buyback announced at the Capital Markets Day in September 2024, with a total volume of €4 billion until the end of 2028. These share buybacks were originally scheduled to begin by 2027 at the latest. Part of them will now be brought forward.

“The earlier start of the share buyback program demonstrates management’s confidence in the underlying financial strength and true value of BASF, which in our view is not fully reflected in the current share price,” Elvermann said.

BASF SE will cancel all repurchased shares and reduce the share capital accordingly.

BASF Group outlook for 2025

BASF maintains its previous assumptions regarding the global economic environment in 2025 unchanged as follows:

- Growth in gross domestic product: 2.0 percent to 2.5 percent

- Growth in industrial production: 1.8 percent to 2.3 percent

- Growth in chemical production: 2.5 percent to 3.0 percent

- Average euro/dollar exchange rate of $1.15 per euro

- Average annual oil price (Brent crude) of $70 per barrel

As a result of the changes in the presentation of the BASF business units OEM automotive coatings, automotive refinish coatings and surface treatment, BASF has made a technical adjustment to the full year 2025 forecasts for the BASF Group as published in the BASF Half-Year Financial Report 2025 (previous forecast from the BASF Half-Year Financial Report 2025 in parentheses, if changed):

- EBITDA before special items of between €6.7 billion and €7.1 billion (€7.3 billion and €7.7 billion)

- Free cash flow of between €0.4 billion and €0.8 billion

- CO2 emissions of between 16.7 million metric tons and 17.7 million metric tons

The difference between the technically adjusted outlook range and the previous outlook range for EBITDA before special items reflects the expected full-year 2025 contribution of the discontinued coatings businesses that are part of the transaction with Carlyle. These are retroactively reported as discontinued operations as of January 1, 2025.

About BASF

At BASF, we create chemistry for a sustainable future. Our ambition: We want to be the preferred chemical company to enable our customers’ green transformation. We combine economic success with environmental protection and social responsibility. Around 112,000 employees in the BASF Group contribute to the success of our customers in nearly all sectors and almost every country in the world. Our portfolio comprises, as core businesses, the segments Chemicals, Materials, Industrial Solutions, and Nutrition & Care; our standalone businesses are bundled in the segments Surface Technologies and Agricultural Solutions. BASF generated sales of €65.3 billion in 2024. BASF shares are traded on the stock exchange in Frankfurt (BAS) and as American Depositary Receipts (BASFY) in the United States. Further information at www.basf.com.

On October 29, 2025, you can obtain further information from the internet at the following addresses:

| Quarterly Statement (from 7.00 a.m. CET) | |

| basf.com/quarterlystatement | (English) |

| basf.com/quartalsmitteilung | (German) |

| News Release (from 7.00 a.m. CET) | |

| basf.com/pressrelease | (English) |

| basf.com/pressemitteilungen | (German) |

| Live Transmission – Telephone Conference for analysts and investors (from 8.30 a.m. CET) | |

| basf.com/share/conferencecall | (English) |

| basf.com/aktie/telefonkonferenz | (German) |

| Live Transmission – Press Conference (from 10.00 a.m. CET) | |

| basf.com/pcon | (English) |

| basf.com/pressekonferenz | (German) |

| Speech (from 10.00 a.m. CET) | |

| basf.com/pcon | (English) |

| basf.com/pressekonferenz | (German) |

| Photos | |

| basf.com/pressphotos | (English) |

| basf.com/pressefotos | (German) |

| Current TV footage | |

| tvservice.basf.com/en | (English) |

| tvservice.basf.com | (German) |

Forward-looking statements and forecasts

This release contains forward-looking statements. These statements are based on current estimates and projections of the Board of Executive Directors and currently available information. Forward-looking statements are not guarantees of the future developments and results outlined therein. These are dependent on a number of factors; they involve various risks and uncertainties; and they are based on assumptions that may not prove to be accurate. BASF does not assume any obligation to update the forward-looking statements contained in this release above and beyond the legal requirements.

P-25-211