Target Kami

For us, business success tomorrow means creating value for the environment, society and business. That is why we pursue ambitious targets along our entire value chain. We report transparently on target achievement so that our stakeholders can track our progress.

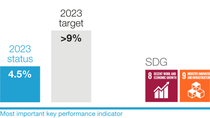

Our objective is profitable growth – we set ourselves the following targets up to and including 2023: We want to grow sales volumes faster than global chemical production, further increase our profitability, achieve a return on capital employed (ROCE) considerably above the cost of capital percentage and increase the dividend per share every year based on a strong free cash flow or at least maintain it at prior-year level.

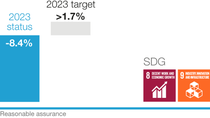

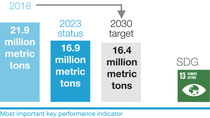

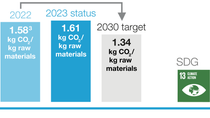

In addition to these financial targets, we have set ourselves broad sustainability targets. We want to considerably reduce our CO2 emissions in the coming years. In addition to the targets for reducing our emissions from production (Scope 1) and the purchase of energy (Scope 2),1 we set ourselves a new target for our purchase of raw materials (Scope 3.1)2 in 2023. We have also added Scope 3.1 emissions to our net-zero target for greenhouse gas emissions by 2050. As part of this target, we are working to strengthen sustainability in our supply chains and use resources more responsibly.

We want to align our product portfolio even more strongly with climate protection and the circular economy. To achieve this, we have further updated the methodology used to assess our product portfolio against defined sustainability criteria and defined a new target figure for products with a particular contribution to sustainability.

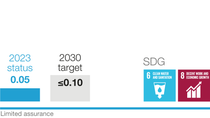

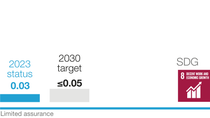

We want to further improve safety in production and since 2023 we have been reporting according to a new system that focuses on high-severity work-related accidents and incidents.

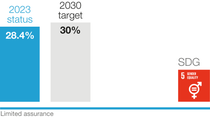

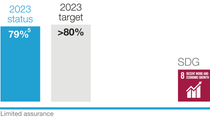

We also aim to increase the number of women in leadership positions and create a working environment in which our employees feel that they can thrive and perform at their best.

The objective of these targets is to grow profitably, and at the same time, contribute to the United Nations’ Sustainable Development Goals (SDGs). We are focusing here on issues that we as a company can influence – especially SDG 2 (Zero hunger), SDG 5 (Gender equality), SDG 6 (Clean water and sanitation), SDG 7 (Affordable and clean energy), SDG 8 (Decent work and economic growth), SDG 12 (Responsible consumption and production) and SDG 13 (Climate action).

Most important KPIs

BASF sets itself ambitious targets along the value chain. Two key figures were of particular importance for 2023:

- Return on capital employed (ROCE)

- Absolute CO2 emissions (Scope 1 and 2)

These most important key performance indicators (KPIs) were the main indicators used to steer the BASF Group up to and including 2023. We also use ROCE for employee incentivization, while the achievement of targets for reducing CO2 emissions (Scope 1 and Scope 2) influences the compensation of members of the Board of Executive Directors and senior executives.

From the 2024 financial year, we will establish two new most important key performance indicators at financial level besides CO2 emissions in order to focus more strongly on the short-term value creation of the BASF Group: The following financial key performance indicators are therefore relevant for 2024:

- Income from operations before depreciation, amortization and special items (EBITDA before special items)

- Free cash flow

ROCE remains relevant for steering in the medium term and for incentivization.

1 Scope 1 and Scope 2 (excluding the sale of energy to third parties). The target includes greenhouse gases according to the Greenhouse Gas Protocol, which are converted into CO2 equivalents (CO2e). The baseline year is 2018.

2 Scope 3.1, raw materials excluding battery materials, services and technical goods, excluding greenhouse gas emissions from BASF trading business. Future adjustment of the baseline in line with the TfS guideline possible depending on the availability of further primary data, among other things. The baseline year is 2022.

Profitable growth

Effective climate protection

Responsible procurement

Resource-efficient and safe production

Committed employees and diversity

1 Scope 1 and Scope 2 (excluding the sale of energy to third parties). The target includes greenhouse gases according to the Greenhouse Gas Protocol, which are converted into CO2 equivalents (CO2e). The baseline year is 2018.

2 Scope 3.1, raw materials excluding battery materials, services and technical goods, excluding greenhouse gas emissions from BASF trading business. Future adjustment of the baseline in line with the TfS guideline possible depending on the availability of further primary data. The baseline year is 2022.

3 The figure for 2022 was adjusted due to increased data availability.

4 We updated the safety targets in 2023.

5 We regularly calculate the employee engagement level. The most recent survey was conducted in 2023.

We act in line with the UN Sustainable Development Goals

Kami telah menetapkan target finansial dan non-finansial yang ambisius agar para pelanggan, investor, karyawan dan para pemangku kepentingan lainnya dapat melihat perkembangan kami.

Target kami adalah untuk:

- Meningkatkan volume penjualan lebih cepat dari angka produksi kimia global.

- Meningkatkan EBITDA sebelum item khusus sebesar 3% hingga 5% per tahun.

- Mencapai Return on Capital Employed (ROCE) diatas biaya modal setiap tahunnya.

- Meningkatkan dividen per saham setiap tahun berdasarkan arus kas bebas yang kuat

- Meningkatkan angka CO2-netral sampai 2030.

- Memanfaatkan kekuatan inovasi kami untuk mencapai 22 miliar Euro pada penjualan Akselerator pada 2025.

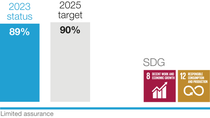

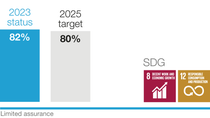

- Mencakup 90% dari pengeluaran relevan kami dengan evaluasi keberlanjutan pada tahun 2025, dan 80% dari pemasok kami akan meningkatkan kinerja keberlanjutan mereka pada saat reevaluasi.

- Kami ingin lebih dari 80% karyawan kami merasa bahwa di BASF mereka dapat berkembang dan melakukan yang terbaik.

Keselamatan bagi manusia dan lingkungan serta pengelolaan air akan tetap menjadi prioritas utama untuk operasi dan perilaku bisnis kami.

Kami mengukur keberhasilan ekonomi kami di sepanjang indikator kinerja utama ini.