Media

BASF Group 1st Quarter 2022:

BASF achieves strong EBIT before special items despite significantly higher energy and raw materials prices

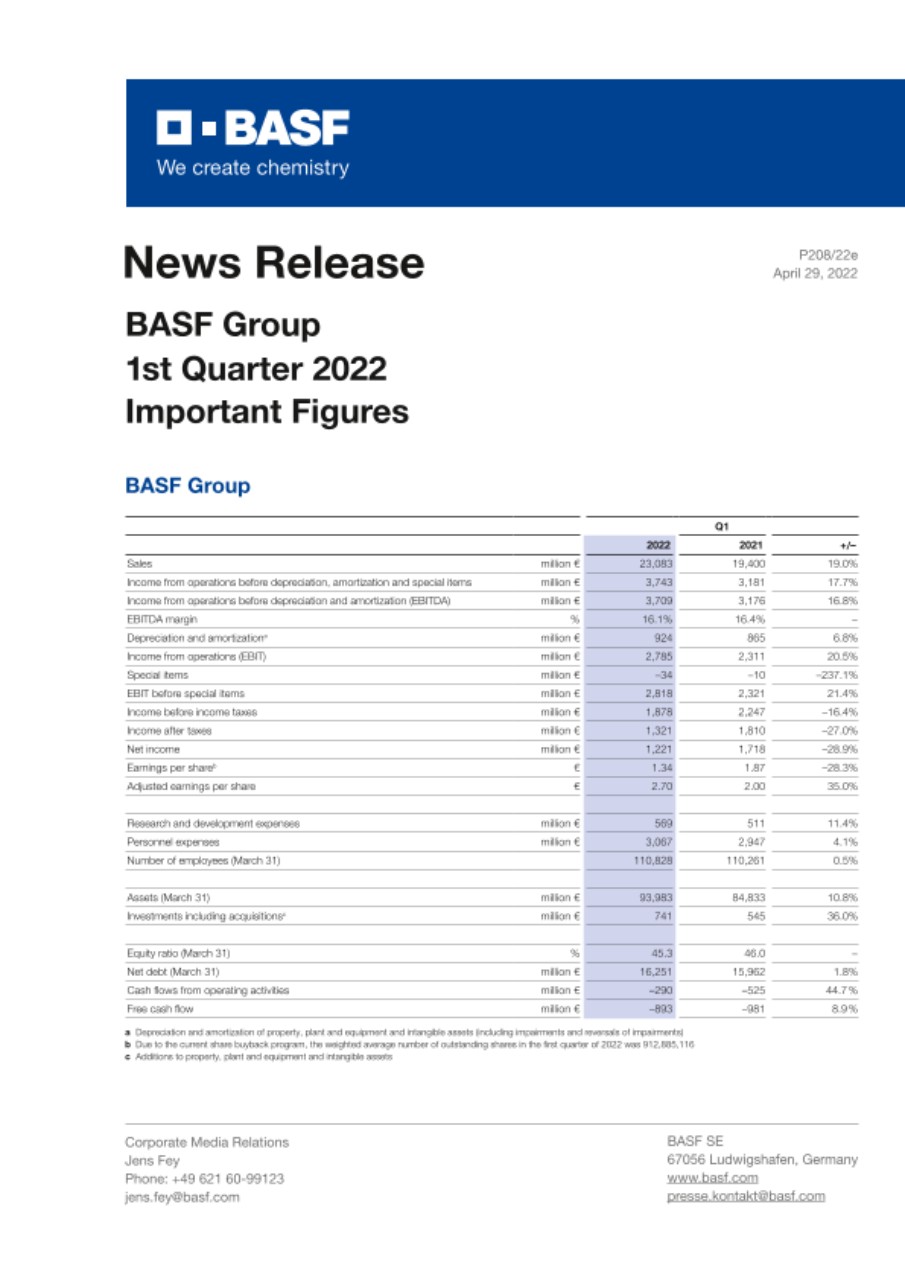

- Sales grow to €23.1 billion (plus 19%)

- EBIT before special items of €2.8 billion (plus 21%)

- Outlook from February 25, 2022, maintained for the 2022 business year

The first quarter of 2022 was characterized by significantly higher energy and raw materials prices as well as supply chain disruptions. “Nevertheless, we had a very good start to the year 2022,” said Dr. Martin Brudermüller, Chairman of the Board of Executive Directors of BASF SE, at the company’s virtual Annual Shareholders’ Meeting this year. BASF had already released preliminary figures on April 11, 2022.

Sales rose by €3.7 billion compared with the first quarter of 2021 to €23.1 billion. Sales growth was mainly driven by higher prices, especially in the Chemicals and Materials segments. Positive currency effects in all segments supported sales performance. Slightly lower sales volumes overall had an offsetting effect. Volumes growth in the Agricultural Solutions, Industrial Solutions, Materials, Nutrition & Care and Chemicals segments could not fully offset the decline in volumes in the Surface Technologies segment.

Income from operations (EBIT) before special items increased by €497 million to €2.8 billion. This was largely attributable to considerable earnings growth in the Chemicals segment. The Industrial Solutions, Materials and Nutrition & Care segments also significantly increased EBIT before special items. The Agricultural Solutions segment recorded slightly higher EBIT before special items. EBIT before special items in the Surface Technologies segment declined considerably, primarily as a result of much weaker demand from the automotive industry.

EBIT rose by €474 million compared with the first quarter of 2021 to €2.8 billion. Net income amounted to €1.2 billion, compared with €1.7 billion in the prior-year quarter. This is due to impairment charges recognized by Wintershall Dea, which BASF included in net income from shareholdings on a proportional basis (72.7 percent) as a special charge of around €1.1 billion. These impairments were triggered by the war in Ukraine and the related political consequences and concerned, in addition to the Nord Stream 2 loan, assets in Russia and in the gas transportation business.

Improved operating cash flow in first quarter 2022

Cash flows from operating activities amounted to minus €290 million, an improvement of €235 million compared with the first quarter of 2021. This increase – despite higher cash tied up in net working capital as a result of higher input costs and the sharp rise in sales – was mainly attributable to the improved operating performance. Free cash flow improved by €88 million to minus €893 million.

Proposed dividend of €3.40 per share

The Board of Executive Directors and the Supervisory Board of BASF SE are proposing a dividend of €3.40 per share for the 2021 business year to the Annual Shareholders’ Meeting taking place today. Assuming a corresponding resolution is adopted by shareholders, BASF will pay out a total of around €3.1 billion on May 4, 2022. “This payment is more than covered by our strong free cash flow of €3.7 billion generated in 2021,” said Brudermüller. The ex-dividend date, the day on which the BASF share will trade without the amount of the dividend reflected in the share price, is May 2, 2022.

BASF Group outlook for 2022

The global macroeconomic outlook is currently subject to very high uncertainty. In particular, it is impossible to predict the further development of the war in Ukraine and its impact on the prices and availability of energy and raw materials.

Consequently, BASF is currently maintaining its macroeconomic assumptions for the 2022 business year:

- Growth in gross domestic product: 3.8 percent

- Growth in industrial production: 3.8 percent

- Growth in chemical production: 3.5 percent

- Average euro/dollar exchange rate of $1.15 per euro

- Average annual oil price (Brent crude) of $75 per barrel

BASF Group’s sales and earnings forecast for the 2022 business year, as published in the BASF Report 2021, is being maintained:

- Sales of between €74 billion and €77 billion

- EBIT before special items of between €6.6 billion and €7.2 billion

- Return on capital employed (ROCE) of between 11.4 percent and 12.6 percent

- CO2 emissions of between 19.6 million metric tons and 20.6 million metric tons

The market environment continues to be dominated by an exceptionally high level of uncertainty. Risks may arise from further increases in raw materials prices and new sanctions against Russia, such as a natural gas embargo, or restricted gas supplies from Russia as a result of counter-sanctions. Further risks could arise from the future course of the coronavirus pandemic and longer-lasting or new measures to contain the number of infections, especially in China. Opportunities could arise from continued high margins.

About BASF

At BASF, we create chemistry for a sustainable future. We combine economic success with environmental protection and social responsibility. Around 111,000 employees in the BASF Group contribute to the success of our customers in nearly all sectors and almost every country in the world. Our portfolio comprises six segments: Chemicals, Materials, Industrial Solutions, Surface Technologies, Nutrition & Care and Agricultural Solutions. BASF generated sales of €78.6 billion in 2021. BASF shares are traded on the stock exchange in Frankfurt (BAS) and as American Depositary Receipts (BASFY) in the U.S. Further information at www.basf.com.

On April 29, 2022, you can obtain further information from the internet at the following addresses:

| Quarterly Statement (from 7.00 a.m. CEST) | |

| basf.com/quarterlystatement | (English) |

| basf.com/quartalsmitteilung | (German) |

| News Release (from 7.00 a.m. CEST) | |

| basf.com/pressrelease | (English) |

| basf.com/pressemitteilungen | (German) |

| Live Transmission – Telephone Conference for analysts and investors on Q1 2022 (from 8.30 a.m. CEST) | |

| basf.com/share/conferencecall | (English) |

| basf.com/aktie/telefonkonferenz | (German) |

| Live Transmission – Speech Dr. Martin Brudermüller (from 10.00 a.m. CEST) | |

| basf.com/shareholdermeeting | (English) |

| basf.com/hauptversammlung | (German) |

| Photos | |

| basf.com/pressphotos | (English) |

| basf.com/pressefotos | (German) |

| Current TV footage | |

| tvservice.basf.com/en | (English) |

| tvservice.basf.com | (German) |

Forward-looking statements and forecasts

This release contains forward-looking statements. These statements are based on current estimates and projections of the Board of Executive Directors and currently available information. Forward-looking statements are not guarantees of the future developments and results outlined therein. These are dependent on a number of factors; they involve various risks and uncertainties; and they are based on assumptions that may not prove to be accurate. BASF does not assume any obligation to update the forward-looking statements contained in this release above and beyond the legal requirements.

P-22-207